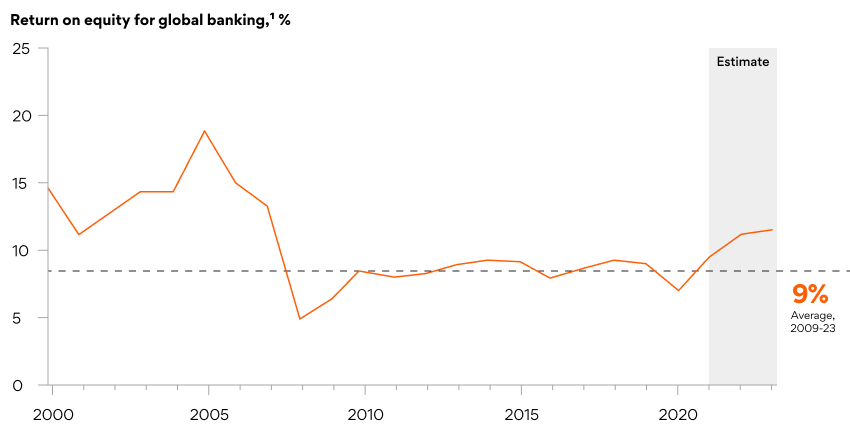

After the 2008 debacle, the banking industry finally had a turnaround with higher-for-longer interest rates globally. Return on equity, a key profitability metric, witnessed a sustained uptick in 2022 and 2023, at 12% and 13% respectively, which had trailed at 9% since 2009. (See the figure below)

But the momentum is undercut by headwinds on several fronts. Increasing regulatory oversight with Basel III endgame mandating higher cash reserves, mounting customer expectations on real-time services, geopolitical tensions leading to market disruptions, and intensified competition from digital natives with a technology leg-up. To sustain profitability, established banking and financial institutions must ramp up efforts that can help them rapidly adjust and respond to these dynamics.

This could be challenging given the monolithic core banking systems that operate on silos and batch-driven updates and cannot fully deliver the digital experiences that customers expect. On the other hand, multi-year complex modernization projects that run into $100 million in costs could be daunting in a microeconomic situation that is at best uncertain and volatile at worst.

Mindset Shift: From a House of Cards to Jenga

Overhauling the core banking systems to a nimbler, interconnected, and more agile technology stack need not be a foundational shift. Our blog outlines an approach to hollowing the core or gradually unbundling existing functionality with newly architected applications and workflows. This makes the core lightweight and builds flexibility and scale into the bank’s technology ecosystem.

Hollowing the core helps banks manage technical debt with cloud-native microservices, leverage cloud capabilities to scale horizontally or vertically, bring sanity into data analytics with a single source of truth, offer real-time transaction and processing, as well as integrate continuous development and deployment practices that speed up cycle times.

This blog highlights a Persistent-proprietary model that takes hollowing the core up by several notches, accelerating the pivot to coreless banking. By marrying strategic technology uplifts with deep domain expertise, our accelerator helps banks with:

- Faster Product Launches: Tapping into a cloud infrastructure that offers agility and scale, banks can accelerate cycle times by as much as 5x.

- Improved Efficiencies: Technology-driven processing helps banks reduce cycle times on customer-facing transactions, reducing the wait time and boosting overall throughput.

- Higher Cost Takeout Measures: By moving away from cost-intensive commercial components such as COBOL to cloud pricing models based on subscriptions or economies of scale, banks can curtail costs by ~60%

- Reduced Risks or Frauds: With integrated data lakes and ready-to-use data pipelines, banks can get granular visibility into customer transactions, which can be analyzed to spot behavioral anomalies to pre-empt frauds.

- Enhanced Governance: Banks can enhance their corporate governance and maintain compliance with end-to-end visibility across the technology stack and relevant insights with digital audit trails.

Introducing Persistent’s Coreless Banking Platform

Persistent’s cloud-native Coreless Banking Platform is powered by proprietary methodologies, domain competence, and robust partnerships, delivering a comprehensive digital banking experience. It works on the tenets outlined by the Banking Industry Architecture Network (BIAN), an industry consortium, and prioritizes:

- API-fication: Built with individual modules using APIs, Persistent’s Coreless Banking Platform enables scalability and adaptability for future requirements. The API-native architecture ensures easy feature development and maintenance, reducing overhead costs.

- Domain Competence With a low code/no code, API-native architecture, domain expertise is crucial. To implement “Hollow the Core” engagements, our functional consultants and domain experts assess the functional landscape to enable a streamlined pivot to coreless banking.

- Customer Appeal: To cater to modern banking customers, we design workflows driven by microservices to take over critical business logic from the core, building speed and personalization capabilities that help banks maintain a competitive edge.

Persistent Modernizes the Core Banking Platform Powering the Consortium of the Atlantic Credit Union System

The client is a consortium of 40+ credit unions operating on a heavily customized legacy core banking system. It was looking for fully integrated technology solutions to deliver a member experience that drives growth while reducing operational and administration costs. Persistent, as the product engineering and systems integration partner, built multi-tenant Mule platform services and React JS-based Teller UI to serve the credit unions. The solution consisted of a modern branch interface portal with over 50+ unique flows and 200+ screens using React JS. The outcome was a reduction in TTM, improved ops efficiency, high customer satisfaction, and multi-tenancy, which helped improve inter-operability between credit unions across 150 branches and 1,500 internal staff.

Persistent has a three-decade-long engineering legacy that puts us at the forefront of driving complex digital transformation projects for global clients. Our alignment with BIAN and proven credentials with global banks enable us to become a partner of choice for most financial institutions, embarking on a re-imagination journey and core transformation.

Learn more about our Retail Banking Solution.

Author’s Profile

Saurabh Joshi

Senior Solutions Expert, BFSI Presales & Solutions