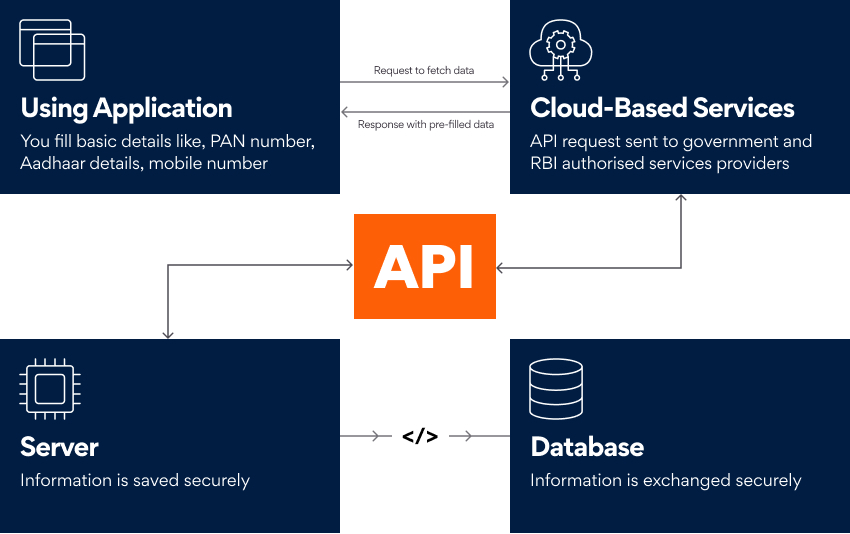

In the fast-evolving landscape of financial services, the emergence of digital lending has disrupted traditional banking, offering unmatched speed and convenience to borrowers. Central to this revolution is a modest yet incredibly powerful technology: Application Programming Interfaces (APIs). These digital connectors have transformed the lending industry, enabling banks and other financial providers (FinTech) to provide better services, and granting consumers access to a more efficient and user-friendly borrowing experience.

Digital Lending is a process of providing credits and loans online. It allows borrowers to apply and avail of credit directly in their bank accounts without visiting their bank. In the context of digital lending, APIs facilitate the seamless exchange of information between lenders, borrowers, and their party service providers.

APIs signify streamlined borrower experience, faster approval, and disbursement. A few use cases of APIs for digital lending include Credit Scoring and Eligibility Calculation, Document Verification, Loan Origination, Data Entry, Risk assessment, and Data Analytics.

How can a borrower benefit from APIs?

APIs for data fetching can significantly enhance your experience for a Do-It-Yourself (DIY) loan application journey by simplifying and streamlining the application process.

- Minimize efforts. APIs minimize the efforts required to fill in the long forms and reduce the chances of errors during data entry. It can automatically populate the application forms with relevant data such as your name, address, contact information, and more.

- Enhancing transparency. APIs also provide transparency and help you understand the eligibility.APIs that access credit bureaus and scoring models allow you to receive instant feedback on credit scores.

- Increased accuracy and reduction in manual checks. APIs also facilitate the extraction of documents, such as bank statements, tax returns, and identity documents, directly from the source.

- Reduced Turn Around Time (TAT) for loan applications. This quick decision-making enhances the overall experience by providing faster approvals or rejections.

- Secured data transmission. Knowing that your personal and financial information is handled securely adds to the positive experience.

How do Banks or Lenders use APIs to enhance the experience and customer relationships?

Banks can leverage APIs at various stages of the digital lending journey to enhance efficiency and user experience and offer innovative financial products. Some benefits are:

- Faster lending decisions. Banks use APIs to access credit bureaus and alternative data sources to gather your creditworthiness.

- Easier data collection. APIs are used to collect and validate the applicant’s data, such as income, employment, and identity information. This reduces annual entries and enhances the accuracy of the information.

- Faster approvals. Banks use APIs for real-time decision-making to provide instant decisions of approval or denials.

- Better integration. Lenders often integrate with third-party services, such as e-signature platforms, document verification services, and financial management apps, to enhance your overall borrowing experience.

- Increased compliance. APIs ensure compliance with financial regulations, including Know Your Customer (KYC) and Anti Money Laundering (AML) checks, which are essential to ensure diligence in digital lending.

Wrapping it up: The Essential Takeaways

APIs can be implemented to develop an optimized digital lending journey by using basic design strategy methods like How-What-Where-Why, Feasibility-Impact Analysis, Usability Testing, User Research, and Iterative design approach.

The multi-skilled team at Persistent Systems brings together design, technology, domain, and business experts to build digital solutions and digitize customer experiences that drive business results. We also have a focused methodology called Digital Greenhouse. This human-centered, design-led approach speeds up your digital initiatives and creates a clear vision with ready prototypes in four to six weeks. Jumpstart your digital journey with Persistent. Visit here for more information.

Author’s Profile

Anusha Gawshinde

Associate User Experience Lead at Experience Transformation