Technological innovations surround us and we have become so dependent on them that anything less advanced would be insufficient for GenZ (and beyond) customers. Smart wearables – which includes smart watches, rings, biosensors and more – as an industry is booming, with new innovations and ideas, causing frequent disruptions. People are ready to pay some hefty price tags to own such devices, as a means of convenience or a status symbol or just due to their tech-savvy nature. Along the way, smart wearables are also enhancing making contactless payments and enabling better banking and consumer experiences., Payments via smart wearables are convenient and multi-purpose, and banks and fintechs are exploring this arena as a new source of revenue for their business models.

As per a report published by MarketsandMarkets, the global wearable payment devices market is projected to reach $82 billion by 2026, growing at a CAGR of 13.6% for the forecast period. This growth is attributed to several factors like the shift from cash/checks to digital payment methods, advancements in near field communication (NFC) technology, emerging demand for contactless payments, hygiene concerns post COVID-19 pandemic, and more. Companies like Apple, Samsung, Fitbit and others are making huge R&D investments for smart wearables to appeal to modern-day customers.

The Power Behind Wearable Payments

Wearable payment devices need to be linked to a customer’s bank account or credit/debit cards. Linked devices can then be tapped or scanned to initiate payments at a merchant’s site. The speed and ease-of-use of wearable payments appeal tech-savvy consumers that want transactions processed as quickly and painlessly as possible. Payments made using wearable devices leverages wireless technologies like NFC and radio frequency identification (RFID) with an integrated chip and antennae. The smaller the size of the device, the smaller the integrated chips and batteries that are required. Users need to ensure that devices are properly charged and the distance from point of sale (POS) terminals is sufficient for NFC/RFID range before initiating the payments. Users just tap or wave their devices near a contactless payment terminal to initiate payments, without the need for any physical card. Merchants are upgrading their POS terminals to Contactless POS (CPOS) to accommodate consumers who want to make payments using their smart wearables. Wearables use host card emulation (HCE) technology to emulate a physical smart card during transactions and use NFC to make contactless payments. Some devices also use QR codes with RFID sensors for payment check-out experiences.

Current Trends in Wearable Payments

Some of the interesting and most innovative wearable payment devices include:

- K Ring-powered payments by Mastercard

- CashCuff shirts

- Cap2Pay

- Fitbit’s fitness trackers

- Connected watches by Apple, Samsung, Tag Heuer, and others

- Payment implants

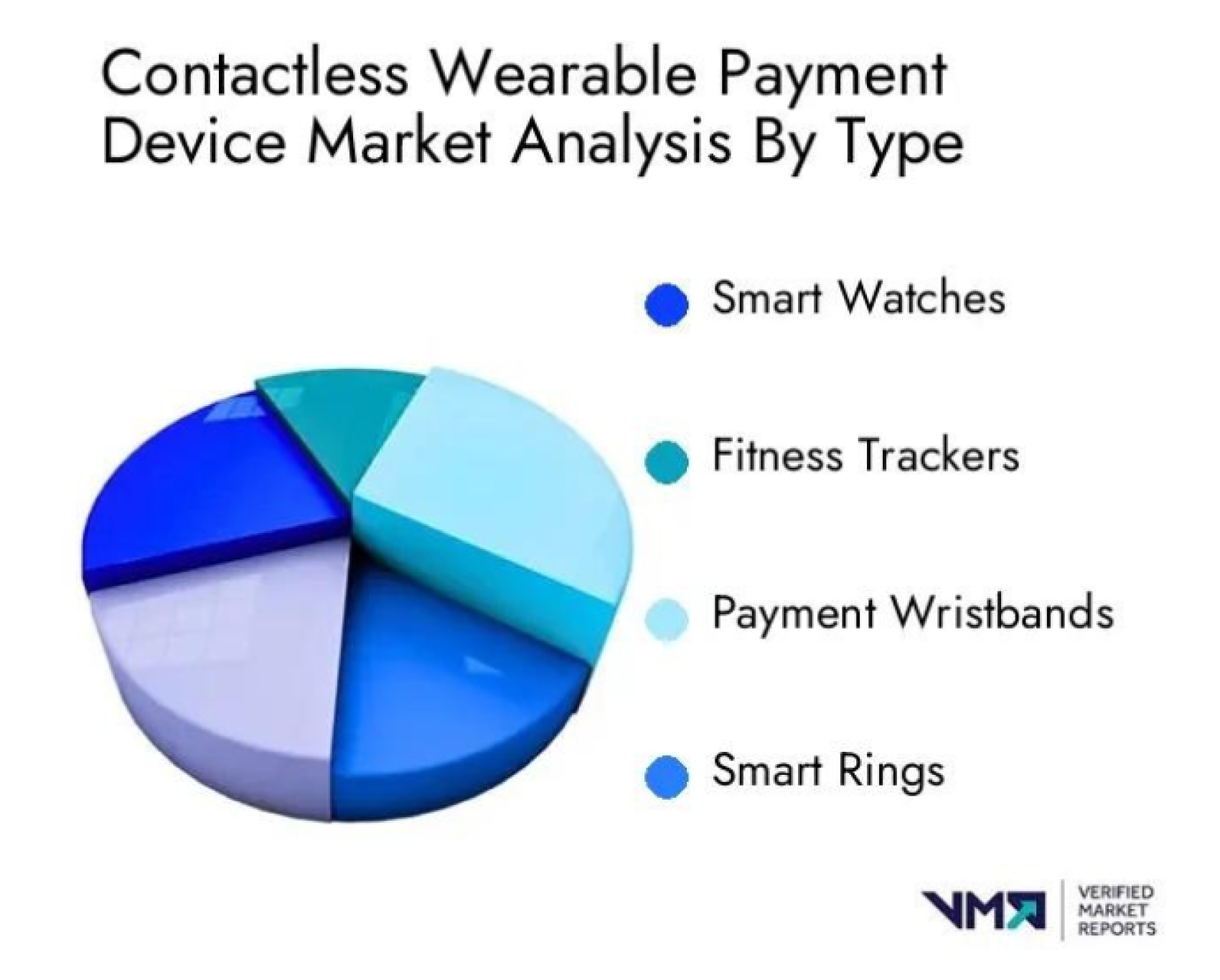

Based on an analysis of the overall distribution of wearable payment devices (Figure 1), no one type of device is currently dominating the market.

Key Challenges for Adoption

Financial institutions are prioritizing how they address challenges to the wider adoption of wearable payment devices.

- Customer acquisition: Wearable payments appeal to certain demographics, ones that all device providers are attempting to reach simultaneously. In addition, the technology required to enable wearable payments has yet to reach much of the world’s population. Customers are also still building trust with the technology., Whenever money movement is involved, customers tend to be very cautious and prefer to use known traditional payment methods. Smart wearables for some are also simply too costly.

- Infrastructure: For wearable payments to work, banks and the merchants need to set-up contactless POS devices, which requires a level of investment and capital that many small banks and businesses might not possess. Institutions that support contactless payments tend to charge extra service fees to defray costs, which in some cases hinders adoption.

- Security: Payment data is highly sensitive and needs to be exchanged over highly secure networks and infrastructures. Any data loss or data leakage can lead to huge financial losses for customers and impact merchants’ brands and reputations.

- Payment limits: Considering its nascent stage, regulatory bodies across the world have placed limits on transaction payment amounts made through smart wearables. For example, the Reserve Bank of India (RBI) has placed a limit of INR 5000 on contactless transactions, so any payment above that limit requires an alternative payment method. These limits could impact customer experience in the long run.

- Data Sharing and privacy: Most wearable devices are IoT devices continuously feeding data into backend systems. This data includes customers’ personally identifiable information (PII), sensitive data like payment details, geo-location data, etc. All this data helps banks and merchants derive insights into customer behaviors that can influence current and future services and offerings. However, such data-driven devices raise concerns among consumers regarding privacy, and banks and fintechs need to ensure that required regulatory controls are in place.

Making Investments for Future Growth

Despite the challenges, the wearable payments market continues to grow and will be a good ROI business case for banks, fintechs and merchants. These players will need to address the challenges, gain customer trust and develop pocket-friendly and economical devices and services to ensure financial inclusion across all the sections of the society. Regulators must enforce stringent controls on contactless payments to ensure customers’ transaction and data security. Governments and authorities will need to support innovations in contactless payments and help deploy the required infrastructure and technology. Finally, consumers will need to be trained and educated on the advantages of using wearables as a multi-purpose device.

At Persistent, we collaborate with multiple clients on their digital payments journey, based on our 32+ years of experience in implementing and modernizing payment solutions. We are also a trusted partner for many financial institutions and merchants across the globe that are implementing wearable payments strategies. For more information on our payments expertise, and how we can help you and your customers on this journey, contact us today.

Author’s Profile

Pooja Arora

Senior Architect, BFSI Payment