What if AI could save your financial institution 360,000 hours of manual work annually while cutting costs by millions? For JPMorgan Chase, this wasn’t just a hypothetical scenario. Its AI-driven Contract Intelligence (COiN) platform achieved exactly that, cutting manual processing time for annual audits by 360,000 hours and saving $150 million within its first year through fraud detection.

This success story is just the beginning. Today, AI is revolutionizing the financial services industry by moving beyond backend operations to power hyper-personalized financial products, real-time risk modeling, and next-generation customer experiences. But as AI transitions from supporting functions to driving revenue and competitive differentiation, financial institutions must confront a critical challenge: how to scale AI responsibly while ensuring trust, transparency, and regulatory compliance.

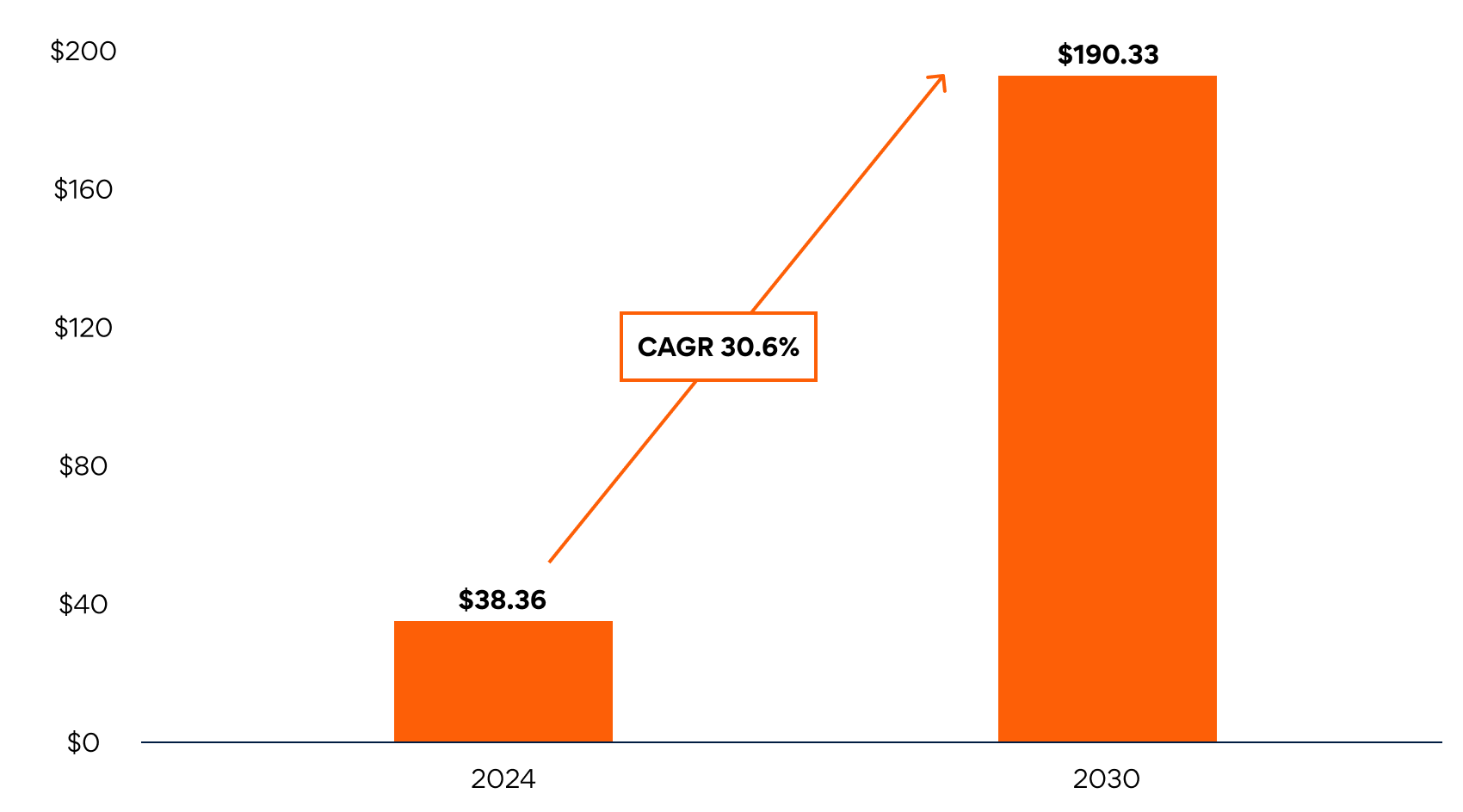

AI in Finance: Market Projection (2024-2030, USD Billion)

By 2030, the AI market in finance is projected to reach $190 billion, growing at a remarkable 30.6% CAGR, highlighting the immense potential and investment in AI technologies within the financial sector. Institutions that fail to operationalize Responsible AI risk regulatory penalties, reputational damage, and customer distrust. However, those that embed AI governance into their strategy will unlock new business value, enhance market positioning, and drive long-term innovation.

Why Now? The Shifting AI Landscape

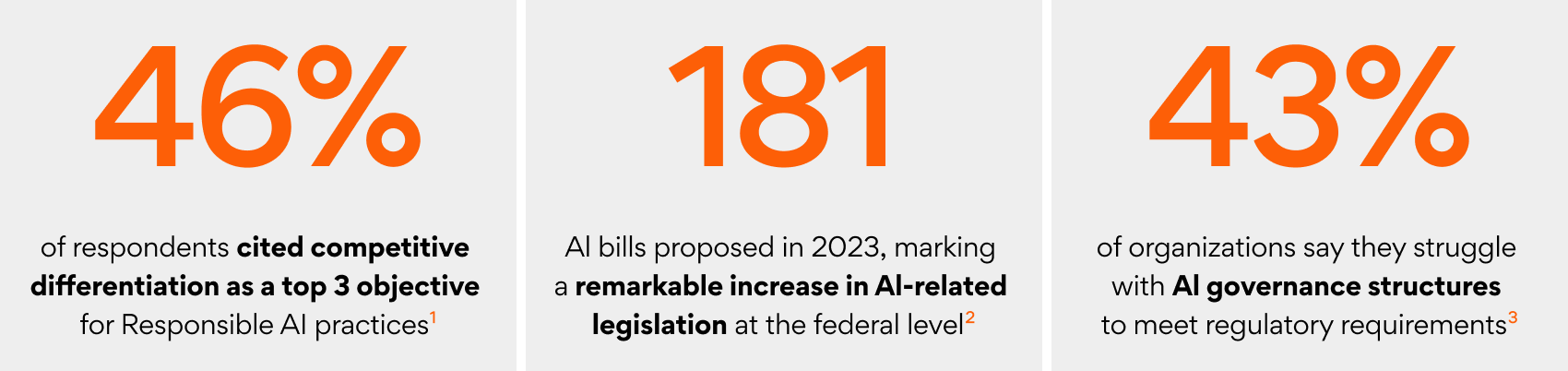

The financial sector is at a pivotal moment. Governments and regulators worldwide, from the European Union’s AI Act to the US AI Bill of Rights, are rapidly tightening AI governance requirements. Financial watchdogs like the OCC and SEC are reinforcing the need for greater transparency in AI-driven decision-making. Institutions can no longer afford a reactive approach to compliance. Responsible AI must be embedded into their core strategy.

Beyond regulations, the demand for trustworthy AI is coming from customers, investors, and stakeholders who expect fairness and explainability in financial decision-making. With the rise of generative and agentic AI, banks and financial service providers must ensure their AI systems are secure, bias-free, and aligned with ethical standards. Institutions that fail to act risk falling behind as Responsible AI becomes a competitive differentiator, not just a regulatory requirement.

The Growing Imperative for Responsible AI: Key Industry Insights

The Challenge of Scaling AI Responsibly

For many financial institutions, implementing Responsible AI at scale is easier said than done and comes with several challenges:

- Complexity of AI Governance: Establishing frameworks that ensure fairness and transparency is difficult, especially when AI models need to be explainable to both regulators and customers.

- Security Risks: As AI adoption grows, firms must protect against adversarial attacks, data breaches, and unintended bias, which can lead to financial exclusion or compliance issues.

- Lack of Standardization: The absence of standardized AI governance across the industry complicates compliance with evolving regulations, making it hard to deploy AI confidently at scale.

- Fragmented Implementation: Without a structured approach, AI remains siloed across departments, increasing risk exposure and limiting its potential impact.

How Financial Institutions Can Implement Responsible AI

To effectively navigate these challenges, financial institutions must take a structured approach to Responsible AI. At Persistent, we go beyond regulatory compliance to help institutions build long-term AI strategies that foster both trust and innovation. Here’s how we support them:

- Tailored Responsible AI Frameworks: We design customized frameworks that embed fairness, transparency, and accountability into AI-driven decision-making, ensuring alignment with regulatory mandates and industry best practices.

- Adaptive Governance Models: AI governance is not a one-size-fits-all model. Our approach provides flexible guardrails that evolve as financial institutions scale their AI capabilities, ensuring compliance without compromising agility.

- Education and Enablement: Through executive briefings and hands-on training, we equip institutions to integrate AI governance into their workflows, ensuring Responsible AI becomes a core business function rather than a siloed initiative.

- Integrated AI Transformation Roadmaps: Our structured roadmaps bridge the gap between governance committees and AI product teams, enabling Responsible AI across key financial functions such as lending, fraud detection, and risk management.

What’s Next? The Evolution of Responsible AI in Finance

While implementing Responsible AI addresses today’s challenges, financial institutions must also prepare for what’s ahead. As AI adoption accelerates, institutions must not only meet current regulatory and ethical standards but also anticipate the next wave of AI-driven transformation. Key trends shaping the industry include:

- Explainable AI (XAI): Investing in Explainable AI will become a business imperative, enhancing regulatory transparency while building customer trust in AI-powered financial products. Institutions that proactively develop XAI capabilities will gain a competitive edge in an increasingly AI-driven industry.

- Agentic AI and Autonomous Decision-Making: The next frontier in AI is Agentic AI, where systems can make autonomous financial decisions within ethical and regulatory boundaries. However, ensuring these autonomous systems adhere to Responsible AI principles will be a top priority.

- AI-Enabled Financial Inclusion: Responsible AI has the potential to expand financial access for underserved populations by reducing bias in credit scoring, improving risk models for thin-file borrowers, and ensuring fair financial decision-making.

- AI-Powered Regulatory Compliance: As AI governance expectations rise, manual compliance processes will no longer suffice. The future lies in automated, real-time monitoring and reporting, where AI itself audits AI-driven decisions, flags biases, and ensures regulatory adherence.

- Collaborative Governance: The future of Responsible AI will require stronger collaboration among financial institutions, regulators, and technology providers. Standardized AI governance frameworks will be essential to ensure AI systems align with evolving regulations.

The Time to Act is Now

The financial institutions that embrace Responsible AI today will not only mitigate regulatory and reputational risks but also gain a competitive edge in the AI-driven financial landscape. As AI continues to evolve, banks and financial service providers must build AI governance structures that are future-ready, scalable, and aligned with long-term business goals.

Is your organization ready to turn Responsible AI into a competitive advantage? Get started today:

- Download our exclusive white paper: “Strategies for Safe, Secure, and Responsible Generative AI” – gain insights into the key principles of Responsible GenAI, a structured risk management framework, and best practices to mitigate risks associated with irresponsible GenAI use.

- Schedule a consultation: Click here to schedule a consultation and explore how Persistent can help you scale AI responsibly while driving compliance, trust, and innovation.

References:

- PwC’s 2024 US Responsible AI Survey

- Stanford’s AI Index Report 2024

- FICO State of Responsible AI Report

Author’s Profile

Akanksha Snyder

Principal, BFSI Consulting