With the combination of already existing economic factors, changes in insurance industry trends, and now, today’s pandemic reality, it has become clear that innovation in insurance has become not only desirable but absolutely necessary. This need for new, effective solutions is a time-sensitive one, as the pace of change is quite rapid, as are the demands to be met. To address this need for acceleration, Persistent has now launched InsurCare, a digital platform that demonstrates how insurance carriers can utilize digital technologies to better engage their members and reduce the rate of severity of claims.

Over the years, the insurance industry was focused on finding the right customer segment for the insurance usage, claims possibilities, and associated risk of default. Accordingly, the minimum possible premiums were derived. To gain market share, firms were not able to increase premiums in proportion to the expenses leading to margin concerns looming over the entire industry.

To overcome this challenge, we are witnessing a change in business strategy as:

In health insurance or in benefits plans, instead of only covering for hospitalization expenses and loss of pay, companies started offering:

- Wellness and Care services to avoid hospitalization

- Pro-active diagnostics and health checkups

- Communities for fitness and Wellbeing

- Digital wearables for wellness tracking

- Doctor and hospital recommendations

In Property & Casualty insurance, instead of only acting as a risk avoidance financial measure, companies are offering:

- Proactive alerts of impending catastrophe

- Maintenance plans

- Smart homes and devices

- Repair services

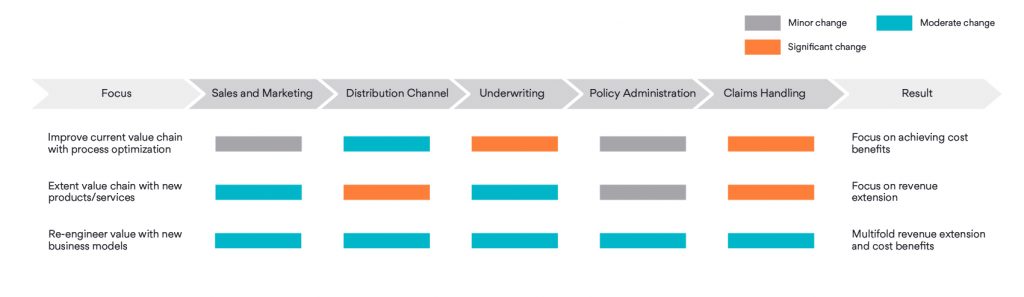

To evaluate this change in detail, we can outline the value stream mapping across key insurance business functions and targeted business outcomes as shown below. For cost optimization in focus, the majority of the Insurtech companies and new-age solutions are developed around Underwriting and Claims handling. Whereas, with new products and services, more customer segments can be targeted to improve revenue. However, if the business model is reassessed to generate value at each business function itself then there is a possibility to attain multifold revenue and cost benefits.

Perhaps, re-engineering the value with different models is not easy to attain for every insurance firm. However, the advent of technology and evolving customer choices has provided an opportunity to envision an insurance ecosystem with benefits at the entire value chain.

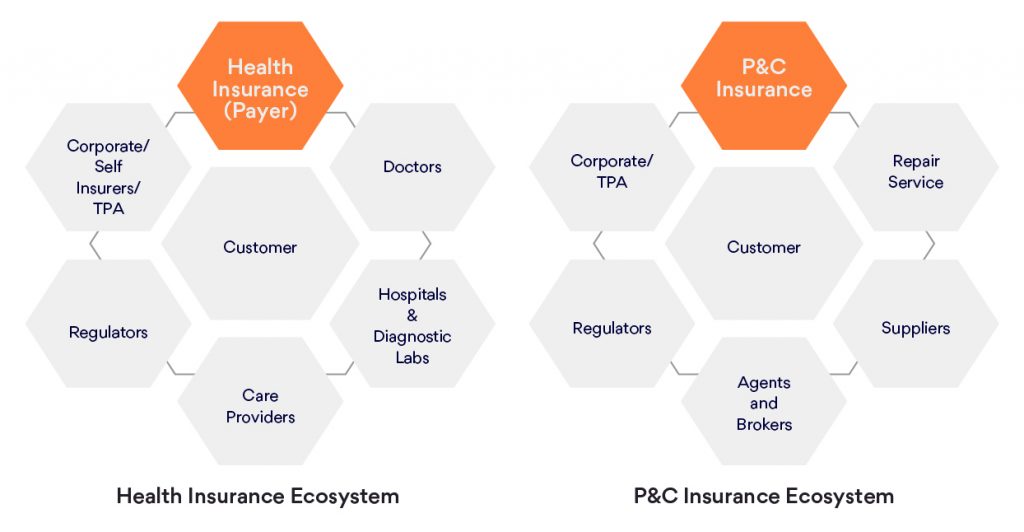

This ecosystem can be entirely different for various insurance types as shown in the below diagram.

Hence, to move up into the value chain insurance companies need to create their own ecosystem as per their current state by:

- Alliances/partnerships with complementary service providers

- Manage processes, business boundaries and customer experience through technology

To achieve this new Insurance business model, a proper digital strategy is also required to unlock new possibilities. At Persistent, we understand the challenge and scrutinized various InsurTech solutions. Accordingly, after careful consideration, we have created a set of next-gen digital accelerators focusing on integrating various touchpoints to provide a seamless customer experience. These accelerators form a set of frameworks, tools, and models to customize within any existing system with minimum effort and help in achieving new efficiencies rapidly.

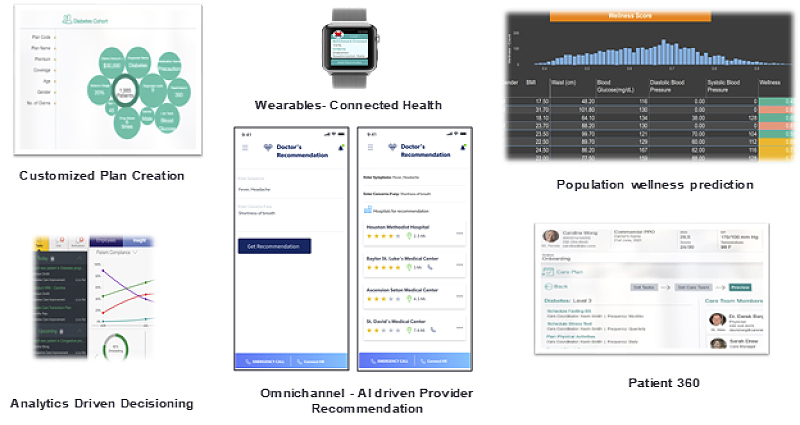

Some examples of these accelerators are:

- Data Foundry Framework to streamline data with robust Governance

- ShareInsights for advanced analytics for data-driven business

- IoT frameworks for wearable data and connected smart devices

- AI-driven recommendation models for agents/providers

- Augmented Reality frameworks for problem assessment such as virtual visits, an inspection of damage, and telemedicine

- AI-driven Wellness and Health risk prediction models

To demonstrate the impact of our accelerators, we orchestrated a Health Insurance and Wellness ecosystem solution – demonstration in the form of InsurCare.

The demo is driven via AI-ML accelerators and intelligent workflow automation to provide a range of business benefits and next-gen customer experiences. A solution that any existing Insurance system can be customized with their extended ecosystem rapidly using this solution blueprint.

Request a full demonstration of InsurCare today and let’s discuss how we can help you deliver an integrated wellness and care solution for your members.

Find more content about

Digital Insurance (3) Insurance Claims (1) Innovation In Insurance (1) Insurcare (1) Digital Engagement (1)