Gartner defines a core banking system as “a back-end system that processes daily banking transactions and posts updates to accounts and other financial records.” Core banking systems typically support deposits, loans, payments, and credit processing capabilities, with interfaces to general ledger systems and reporting tools.” In simple terms, a core banking platform is like the ERP (Enterprise Resource Planning platform) for financial institutions.

Banks and credit unions relied on monolithic core platforms to run their banking operations which offered reliability, security, and scalability. However, over the last five years, competition in the banking industry has intensified in a very fundamental way. Neo-banks are winning market share and serving customers at around 1/3 of the cost of traditional banks. Fintechs are targeting lucrative niches in the banking value chain with control over end customer experience. With their large customer bases, big tech players are also becoming a real threat to traditional banks & credit unions. These new players are growing their businesses and attracting customers with the help of modern cloud-native core technology and micro-services-based architecture, which enables them to innovate faster and operate more efficiently. Understandably, incumbent banks are increasingly concerned about the limitations of their core architectures and their relatively slow pace of change. As a result, they are looking beyond their core providers for four reasons.

We see four key areas in which legacy monolithic core platforms inhibit performance:

- High Cost: technical debt in legacy systems consumes large chunks of IT spend

- Constrained Time to market: Being able to launch products quickly is a critical competitive differentiator in today’s crowded marketplace.

- Limited Personalization: Customers increasingly expect a personalized experience. But banks often store data in multiple product-aligned core systems, which inhibits catering to individual needs.

- Excluded from Ecosystems & Open Banking: Partnerships are becoming critical to creating the products and services of the future. Yet current architectures lack the connectivity to third parties that would enable innovation

The good news for incumbents is that the tools are at hand to address these challenges. Microservices are an essential software trend and one that can fundamentally alter digital transformation initiatives and can set Banks and Credit Unions up on a path towards monetizing customer data using third party providers. Microservices vs. monolithic architecture represents a fundamental shift in IT approaches software development and has been successfully adopted by organizations like Netflix, Google, Amazon, and others.

Traditionally, core banking platforms have been large, monolithic, on-premise platforms that required banks to lock into one vendor’s ecosystem for years at a time. Migrations required a multi-year and multi-layer journey and changes took years to materialize. Alternative new cloud-native platforms have de-risked this. Micro-services-based banking services are driving the future of digital banking and are expected to gradually eat into services offered using monolithic core banking platforms.

Banks can leverage the power of the cloud by developing cloud-native applications. These are designed and deployed as a set of flexible microservices using platform-as-a-service (PaaS) tools — which can further reduce costs, boost performance and increase a bank’s business velocity. Beyond the obvious benefits of cost reduction, scalability, and speed of deployment, a cloud-native architecture offers greater agility – it enables a bank to do previously impossible things, limited by their core banking platform. Banks can mix and match “best of breed” solutions from their fintech partners and replace solutions when something better comes along, rather than being locked into a specific technology. With this approach,

- Banks can become innovators, build new products, and scale the business. They can achieve business agility that is impossible for a bank with a monolithic core. New products and services can be launched quickly and cost-effectively, with cutting edge customer experiences

- Banks can create new revenue streams by joining the Banking as a Service (BaaS) ecosystem. Instead of competing with FinTechs, structuring FinTechs as part of their ecosystem is beneficial for both.

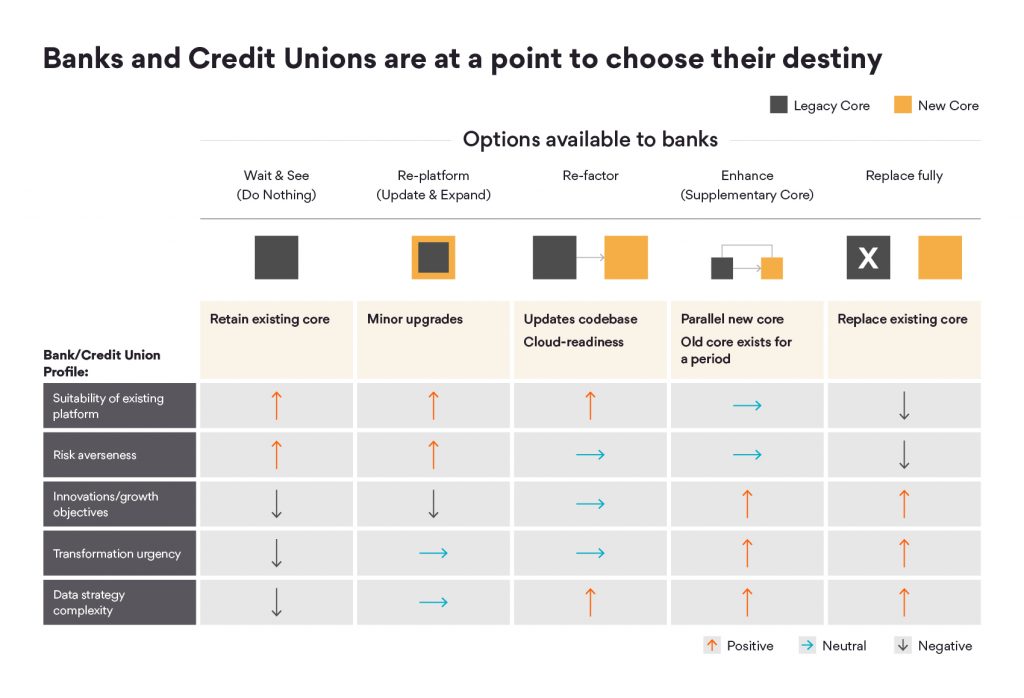

It is not about ‘making the change’ anymore for banks and credit unions to stay in the game. Today every institution must ask themselves if they can survive the next 5-10 years if they do not make the required changes.

CXOs of banks and credit unions in the past have made excuses for not embracing a flexible, agile cloud-native core banking platform on long-term-sticky contracts with their core banking providers and budget constraints. They now have a choice to adopt a ‘dual core’ strategy, take a step-wise approach of moving new deposits and loans onto the new platform, grow their business through better customer experiences and gradually move towards a flexible core in 2-3 years. To make this a realistic approach, there are various flexible low upfront and low total cost of ownership (TCO) pricing approaches that banks and credit unions can take advantage of to look beyond their current core providers and control their own technology roadmap.

Learn more about how Persistent can help you look beyond your core banking systems.