Traditional insurers are plagued with limitations in legacy systems as they seek to adapt to digital transformation and the acceptable expectations of digital customer experiences. , lack of digital tools, and operational inefficiencies in their underwriting process. Further, the increasing redundant paperwork for multiple product application and longer cycle times negatively impacts the overall customer experience. Many insurance companies and banks experience anywhere from a few days to several weeks to conclude their underwriting services. Internal staffing policies, the number of applications, loan profile complexity – are only some of the factors which may affect the ‘turn time’ of lenders.

With the rising need for an automated, data-driven process, the industry stands at an inflection point, and now insurance companies need to re-evaluate their underwriting process and secure a sustainable advantage in the coming years. Many Insurers have already adapted to advanced InsurTech solutions to streamline their operations and deployed the algorithmic underwriting process. In this context, we predict a transformative reduction in the buying cycle of insurance by customers as the underwriting and application process move to near real-time.

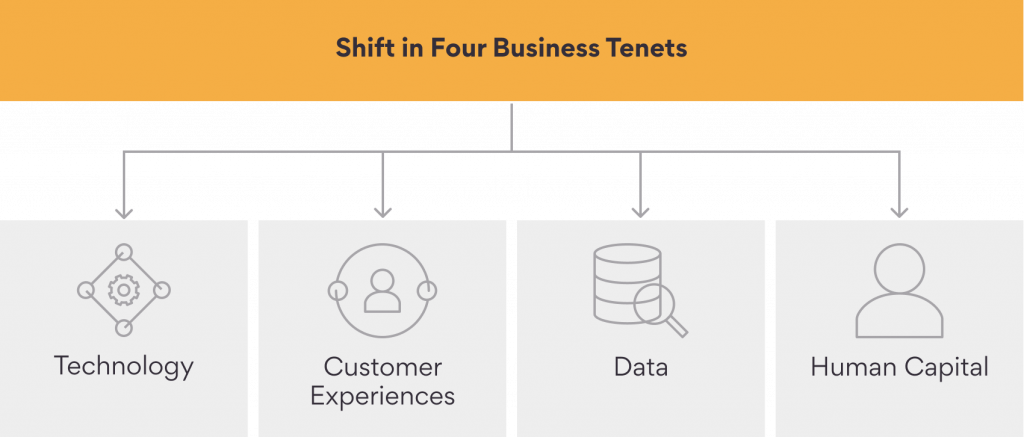

Automated underwriting refers to a technology-driven process that delivers an automated decision. Automation in underwriting enables insurers to digitize the currently manual process through automation, reducing the time for underwriting decisions. For insurers to overhaul their underwriting process, we envisage a fundamental shift in below four core business tenets: technology; customer experiences; data; and human capital.

- Technology – Modernization of legacy system: Much of the legacy technology stack responsible for manual purchasing journey needs to be adapted to end-to-end automated platforms. Modernizing core insurance processes and platforms with solutions based on cloud-native architecture and intelligent automation would facilitate end-to-end digital workflows and faster IT development, in turn presenting seamless experience to underwriters.

- Customer experiences – Digital and personalized: Without digital touchpoints and omni-channel experiences, buyers quickly lose interest in the underwriting process. The convenience of ‘Fluidless Underwriting’ is a driving differentiation for insurers. Underwriters must go beyond traditional customer mapping journeys and instead enhance distribution partnerships, employee interactions, and front-end customer experiences through digital capabilities.

- Data – Granular assessment of risks: Traditionally, underwriters were dependent on static, historical information to develop rules for risk assessment. However, it may not predict future exposures accurately. As modern underwriters re-evaluate how they look at risk, the shift presents great opportunities. Data, such as mortality and morbidity data present new sources of insight to streamline current underwriting and enhance the understanding of risk to enable more refined risk categorizations.

- Human capital – Talent management: In terms of capabilities, the biggest gap in traditional underwriters seems to be in emerging data skills and new technology capabilities. Underwriters must develop capabilities in data strategy and management, data analytics, and intelligent automation to upscale the process efficiencies. The accelerated process would also mandate coordination of traditionally separate teams – underwriting, risk, legal, actuarial, compliance, distribution, IT and marketing, putting added demands on collaboration and stakeholder buy-in across the organization.

Underwriters are required to meticulously evaluate and process the applications that are not classified as Straight Through Processing (STP) or repeat scenarios, resulting in higher response time. We solved this problem by accelerating the response time of underwriters and enabled them to make decisions faster for the leading Life Insurance company.

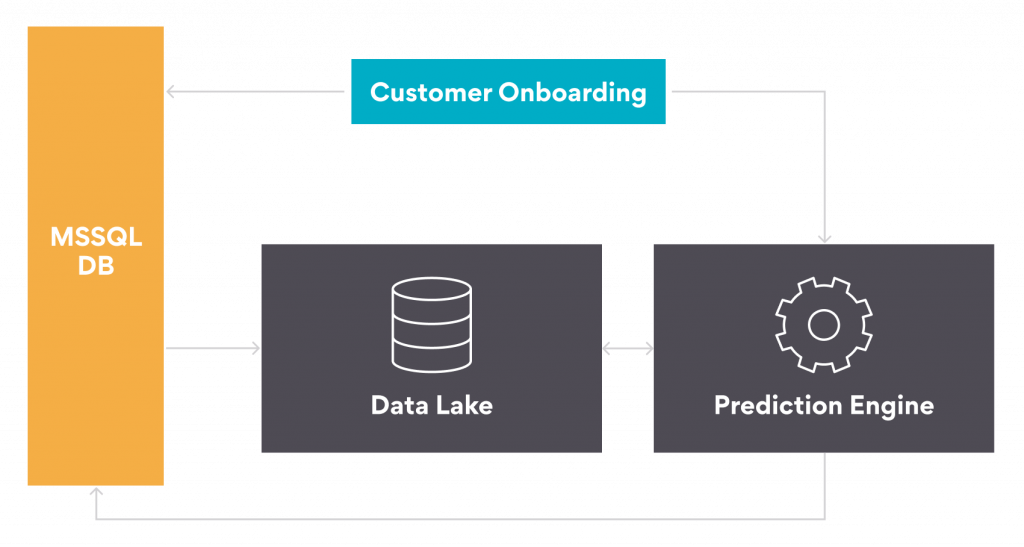

Machine Learning Platform Architecture

We delivered an underwriting engine with machine learning capabilities that provided insights to underwriters using patterns based on historical data. The solution involved ingesting streams of historical data from different systems to train machine learning models, which were used to derive recommendations in real-time. The decision processing time of the recommendation engine was under 20 seconds, and it recommended thousands of underwriting policy decisions in a day. The Model-based recommendation engine enabled judicious utilization of the existing underwriters resulting in a host of benefits for the Insurance company:

- Improved customer experiences

- Increased decision accuracy

- Reduced compliance risks

- Significant reduction in the operational costs

In addition to streamlined underwriting, our solution also lays a strong foundation for adopting a platform-based approach to data management and cognitive solutions within the organization. With advances in AI and automation, the Underwriting process can completely transform customer experiences by improving the overall Policy Administration System (PAS), customer onboarding process, and claims management time.

To sum up, the landscape of Insurance is changing rapidly, and underwriting is on the cusp of a fully digital transformation. At Persistent Systems, we help Insurance firms bring about this transformation and stay relevant in a disruptive era.

Learn more about our Digital Insurance capabilities.