TL;DR: Generative AI can help insurers tap into opportunities worth $1.1 trillion. However, with growing ethical and data privacy concerns, the insurance industry needs a holistic approach across processes, people, and organizational structure to confidently onboard Generative AI solutions.

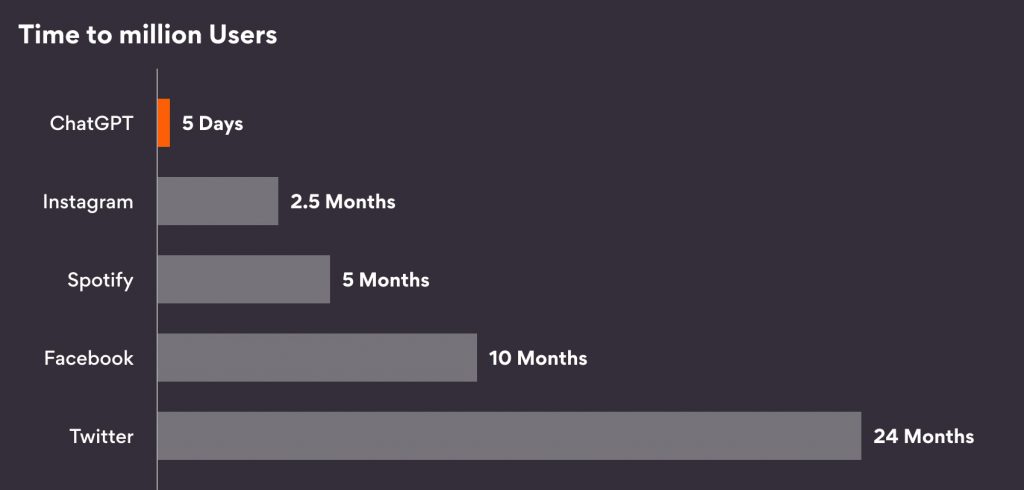

What took Twitter two years, Facebook about ten months, Spotify five months, Instagram two-and-half months, but only five days for ChatGPT?

The time to a million users.

Nothing captured public attention like a Generative AI-powered chatbot that could write collegiate-level essays, decipher intentionally obfuscated code, or compose art or music just like humans would. But this barely scratches the surface. The true Generative AI impact will manifest when enterprises adopt it at scale, transforming how they leverage data, glean insights, make decisions, and engage customers.

Especially for insurance which, as an industry, had a different pace in adopting new technologies. McKinsey estimates that ChatGPT for insurance (or its peers) offers new revenue opportunities worth $1.1 trillion – approximately $400 billion could come from pricing, underwriting, and promotion technology upgrades and $300 billion from AI-powered customer service and personalized offering. This is not the bus insurers want to miss.

Generative AI Impact Areas for Insurance

Insurers can target four primary business areas with Generative AI solutions. These are:

- Engagement: Generative AI can help create personalized omnichannel outreach content to help insurers establish trust and recall among current and prospective policyholders. Insurers can elevate transactional, customer-initiated conversations to continuous, insurer-led engagement that fosters loyalty with ready-to-go emailers, blogs, social media posts, and digital agents to answer customer queries or concerns, create awareness, and differentiate the brand.

- Decision Making: Generative AI can help insurers quickly analyze large volumes of unstructured data, glean insights or critical information from heavy documentation, and enable underwriters or adjusters to process claims at speed. Generative AI tools can be trained and embedded within the workflow to learn from past claim settlements and suggest possible resolves for claims currently under processing against standard parameters. This can enable 100% straight-through processing for most low-value, high-volume straightforward liability claims (within pre-defined thresholds).

- Data Analytics: Insurers can now mitigate a percentage of moral hazard by analyzing behavioral patterns through real-time data from sources such as claimant interviews, third-party entities, social media posts, or news with Generative AI. For instance, it can scan a prospect’s social profile and behavioral cues on third-party websites to assess and reveal critical insights such as smoker or non-smoker, current lifestyle, or past claim history. This widens the net of data parameters considered while issuing policies or settling claims. It allows accurate risk pricing and increases insurance coverage for a larger underserved or underserved cohort.

- Organization Structure: Generative AI tools and solutions will require insurers to reimagine the current operational structure as a flat, cross-functional organization with seamless data flows from one department to another. For example, for multi-line customers or those that have purchased several insurance policies, such as health, auto, life, etc., from the same insurer, Generative AI solutions need access to cross-functional databases to answer queries or redirect them to the most suitable human agents. This will usher in the much-needed breaking of silos that have stalled front-to-back digital transformation for most insurers.

The Grind Before the Flight

While Generative AI captures imaginations, the road to materializing ‘what could be’ is long. As mentioned earlier, the scenarios will remain moonshots if insurers try to adopt Generative AI as an additional layer to their existing stacks. As with any other AI solution, Generative AI will need considerable groundwork, cultural reorientation, and executive buy-ins to deliver business returns. Purely on the technology side, insurers will need to factor in the below limitations:

- Integrity: Generally available Generative AI models are probabilistic in nature, i.e., the output they produce is based on the datasets they have been trained on and are, at best, the nearest approximation to the truth. This means the output of a Generative AI solution may or may not be true or could be partly true. Also, since foundation models backing generally available solutions such as ChatGPT (GPT 3.5 or GPT 4) are trained on vast open-source data with little contextualization, they cannot be readily deployed to serve industry-specific use cases. Moreover, since these solutions are also open source, there is no guarantee that the data fed to them will not be exposed outside the organization. Due to these reasons, two in three customers tend to or fully distrust Generative AI interactions in their insurance journeys.

- Explainability: Concerns around the explainability of Generative AI continue to mount as experts grapple to reverse engineer the reasoning behind the output. Most Generative AI solutions are black-boxed for now, and explaining the output is complex. This bears significantly for insurers that want to entrust Generative AI solutions with underwriting or claims processing decisions. Insurers need to arrest false positives or negatives, which may not stand to the validations of regulatory authorities. Insurers will have to invest time and resources to understand how Generative AI solutions operate and the logic that assigns weights to possible outcomes to come up with the nearest-to-truth answer.

- Ethics: Generally availableGenerative AI technologies, since they are trained on swathes of open-source and unstructured data, can be disputed for churning out racial, social, and gender-biased outputs. For instance, encoded biases in historical data would make a Generative AI model flag activities from a person of color to be fraudulent. Insurers must be wary of deploying these tools to make policy decisions that could favor one customer cohort over another. These tools must be retrained via Reinforcement Learning from Human Feedback (RLHF) which requires a human to score the output on a scale of most appropriate to the least and send the feedback to retrain the foundation model.

Take the Generative AI leap with Persistent

At Persistent, our Generative AI philosophy mirrors Richard P Feyman’s, who said, “I would rather have questions that can’t be answered than answers that can’t be questioned.” We prioritize responsibility, accountability, and transparency when building Generative AI solutions. Our deep partnership with hyperscalers, such as Microsoft and AWS, makes us the preferred partner for leading insurers to help them responsibly onboard Generative AI solutions at scale.

Our insurance experts collaborate with our hyperscaler partners to fine-tune foundation models with industry use cases. These models are trained on responsibly curated data attributed to sources, undergirded by solid privacy and security guardrails, and ready to be adopted at scale. Our in-house practitioners have built insurance-specific solutions based on these foundation models to accelerate time-to-value from underwriting, policy comparison, and claim processing to fraud detection and customer engagement.

These are:

- Policywise simplifies insurance product comparison across multiple parameters to provide comprehensive insights to the users.

- ResponseWizard scans multiple data sources to extract relevant information for drafting responses, saving time and effort for agents, underwriters, claim handlers, and back-office teams. This ensures timely and customer-centric interactions, improving overall response quality and customer satisfaction. ResponseWizard helps insurers adhere to SLAs and foster strong customer relationships.

- SmartUnderwriter helps underwriters access and evaluate data from multiple sources. It offers a natural language query interface and is adaptable to different underwriter personas, such as mortgage loans or healthcare insurance underwriting.

- GURUChat is a Generative AI-powered digital assistant that helps adjusters understand lengthy policy documents and provides concise details from investment product documents. Its interactive chat interface enables effective communication better to understand policies and their implications on the go.

- NeoGenAIFast helps insurers seamlessly transition from ontology to graph and eventually to knowledge graph. Our LLM-based technology creates and saves ontology, as well as nodes and relations, and visualizes them. Insurers can easily load synthetic data to understand how it looks and query their data.

Persistent can help you create and onboard your own Generative AI solutions to supercharge operations, customer engagement, and fraud detection. Get in touch with us here.