The adoption of cloud computing has stoked a software revolution, as businesses and consumers alike move away from owning discrete software products run on premise and licensed on an annual basis to “anything as a service” (XaaS) platforms they access over the web, often for a monthly fee. The pandemic only accelerated this trend, with Gartner predicting that spending on XaaS offerings will grow more than 23% in 2021 alone.

As ISVs rush to meet market demand for cloud-based XaaS offerings, they’re also forced to consider new business models capable of delivering on profitable growth targets. The legacy approach of selling individual units or annual licenses as dedicated software products increases acquisition costs unnecessarily, creating barriers to purchase that simply can’t compete in a XaaS world of low acquisition costs and pay-as-you-go pricing models.

ISVs must understand that the legacy approach to developing and monetizing software products simply won’t work for XaaS platform development, given the go-to-market strategies being employed by competitors and the market expectations that have been set by cloud leaders like Amazon, Microsoft, and Salesforce. New approaches to monetizing software platforms are needed.

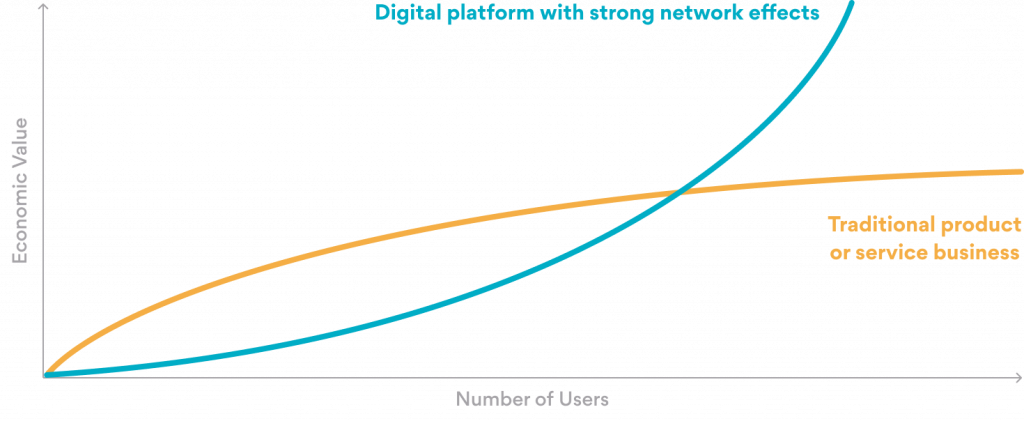

The power of the network effect

Product-based organizations measures their success based on metrics like number of units sold, market share the company has acquired, or profitability margin. As the userbase grows, the actual value to the end user diminishes over time.

Early users of Microsoft Office enjoyed productivity and production benefits that simply weren’t possible using other digital and analog tools at the time. But eventually, Office became the de facto standard in the business world, eliminating the advantage early adopters enjoyed.

Platform software is exactly the opposite: as the userbase grows, the value conveyed to each user increases. Social media companies are a perfect example of this network effect in action. In the early days of Facebook, few users meant low value as little content was created and users were forced to connect with others through alternate channels. With 2.89 billion active monthly users worldwide in Q2 2021—almost half the global population!—many individuals and businesses find it impossible to NOT become active Facebook users or risk being out of touch with the individuals and organizations they care about most.

Here are several ways you can harness your platform’s growing userbase to drive new paths to profitable growth.

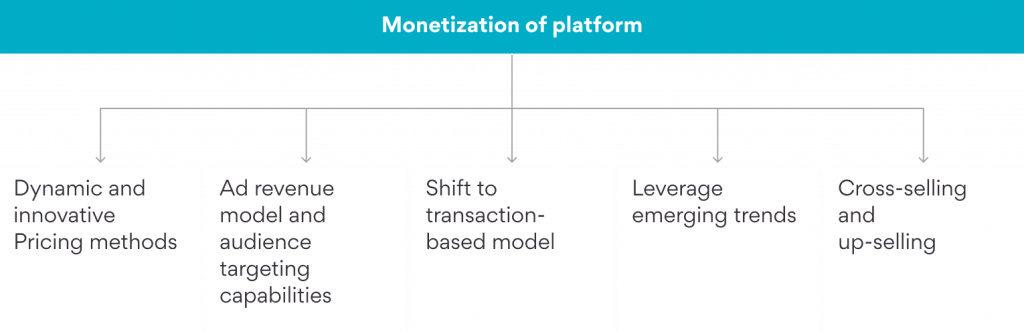

Five ways to use the network effect to monetize your platform

1. Shift to transaction-based model

Digital platforms function as a marketplace facilitator by bringing supply and demand together, creating opportunities to drive incremental revenue on a per-transaction basis. PayPal and eBay have become massive successes by just taking a few dollars or a couple percentage points from each sale—not enough to create a hurdle to individual adoption, but enough to create incredibly large and durable revenue streams.

Platforms that adopt this model must be focused on removing friction from all aspects of the matchmaking process to grow the userbase and make it as easy as possible for buyers to find sellers and vice versa.

2. Leverage emerging trends from network to increase usages

As the number of participants increases on the platform, unexplored trends will emerge, which can be discovered through extensive data analysis using predictive machine learning and AI capabilities. Best of all, these insights can only be known and acted on by the platform itself, delivering a sustainable competitive advantage.

For example, Netflix continually studies what its customers watch, then use those viewing patterns to invest in new content that delivers a steady pipeline what its customers are looking for.

To capitalize on this monetization strategy, platforms must be agile enough to quickly create additional content, products, and services that align with user’s requirements, keeping users engaged and the competitors in the rearview mirror.

3. Cross-selling and up-selling

The use of data models to understand purchase history patterns can create a powerful recommendation system. Amazon is the gold standard in this regard, using powerful recommendation algorithms to cross-sell or up-sell customers and deliver uniquely personalized engagement experiences that delight customers and create significant loyalty.

4. Ad revenue model and audience targeting capabilities

Platforms can take years to implement an ad revenue model and turn a profit once the platform has reached enough critical mass to interest advertisers. But that adoption curve gets steeper all the time as the digitization of society increases.

For example, Facebook may have taken three years to reach 50 million users—a massive number to be sure—but WeChat reached that milestone in just one year. Social media isn’t the only example of rapid adoption, however: the augmented reality mobile game Pokemon Go onboarded its 50 millionth user in just 17 days!

To be successful, a platform must offer unique audience targeting capabilities to differentiate from other advertising options, ensuring that every advertising investment is maximized. ML/AI capabilities can dig into the rich history of first-person data the platform captures, parsing the data in such a way that advertisers can’t help but invest more in these digital channels.

5. Dynamic and innovative pricing methods

As mentioned above, product pricing is usually fixed, no matter how much of the product is consumed over a period of time. The only opportunity to pay less per license is with volume pricing.

Platforms, however, can take advantage of dynamic and innovative pricing models based on the ways users derive value from the platform. Some options include:

- “Freemium” pricing that allow users to engage with some or all of the platform for a period of time before any payment must be made. The “30-day trial” is a common example.

- Membership fees with unlimited use (think Amazon Prime) or subscription offerings that deliver consistent value for less cost (annual pricing at 20% less than the monthly rate, for example) encourage frequency of usage or to reward customer loyalty.

- Pay-for-what-you-use pricing models function like your utility bills: the less you use, the less you pay. Marketing automation companies offer tiers of pricing based on the number of target records in your database, or the number of emails you send out each month. Cloud storage vendors often charge based on the number of gigabytes used.

These adaptive pricing methods, which are in context with business needs and phases of its lifecycle, helps in increasing the adoption and scale of the platform.

New value delivery models need new profitable growth strategies

ISV should devise their monetizing strategies in the design phase of the platform itself, while the business case is being made. Companies must consider the distinct characteristics of the platform, considering the network effect that can make them far more successful than legacy products and services pricing.

Look at the most valuable companies in the world today; each of them is leveraging network effects to deliver unrelenting growth and profitability. The dynamic and innovative potential of the software platform model demands equally dynamic and innovative revenue production models to maximize the ISV’s growth and profitability.

At Persistent, we deliver solutions that drive agility and responsiveness by helping organizations develop new products faster, manage costs in business operations and derive insights from performance data.

Learn more about Persistent’s services focused on the Software & Hi-tech companies struggling to redefine the customer experience, capitalize on digital convergence and launch new business models.