Community banks and credit unions are caught in a vise that tightens a bit more each day. Large banks are applying pressure from one side by focusing their considerable resources on winning the digital transformation race, delivering a differentiated and superior customer experience in the process. In addition, COVID has accelerated the need for Digital Onboarding/Digital Lending as fewer people walk into brick and mortar banks.

On the other side, a host of fintech pure plays, neo banks and challenger banks are exploiting their inherent focus and access to venture capital to rapidly reinvent the sector with new digital offerings delivered at a speed and profit margin the industry giants couldn’t dream of.

Where does that leave the tens of thousands of community banks and credit unions that can’t move as quickly as the smaller disruptors or match the technology investments of the large players? Feeling squeezed and falling behind, forced to rely on their greatest differentiator—personal relationships—during a global pandemic when face-to-face contact and relationship building opportunities are rare to non-existent.

Community banks and credit unions need digital solutions that can:

- Help accelerate the digital transformation journey

- Tilt-up quickly, and deliver value just as quickly

- Improve overall customer experience

- Dramatically reduce cycle times for new business opportunities

- Build around and integrate with existing IT investments

Persistent’s Digital Banking and Credit Union Solution applies years of global fintech integration and solution experience to help community banks and credit unions achieve all these goals and more—at a price that fits the budget.

The Digital Mosaic: Putting the pieces in place

A decade ago, digital banking solutions were large, monolithic, on-premise platforms that required banks to lock into one vendor’s ecosystem for years at a time. Today’s fintech market offers an abundance of niche application providers, addressing everything from mobile apps, digital deposits, and loan origination to underwriting and payments with highly focused products.

These microservices are the future of digital banking, gradually eating away at the monolithic core banking services of a generation ago. Any digital banking solution that requires locking in to one specific vendor’s offerings is putting their own needs ahead of their customers’ needs, depriving them of the ability to choose from the best available offerings in the market.

These solutions run contrary to the trend towards composable architectures capable of providing the plug-and-play capabilities needed to support the flexibility modern solutions require.

Which is why the Persistent Digital Bank and Credit Union Solution relies on our Digital Mosaic approach, ensuring the solution is:

- Flexible: able to tightly integrate any number of niche products and applications in the current solution stack.

- Customized: based on the needs and the best available software and services for the business, including market leaders like Salesforce, Mambu, nCino, Sapiens Decision, Identity Minds and more.

- Cloud-based: our hybrid cloud platform partners with leading providers like AWS, Microsoft Azure and IBM Cloud to accelerate deployments, minimize maintenance costs, and allow you to pay only for what you use.

- Scalable and responsive: our solution grows as you grow and can rapidly scale up and back to handle typical bursts in throughput and processing activity, so you never miss an opportunity.

- Customer-centric: data flowing freely across our end-to-end Digital Banking Solution ensures your customers’ needs and information are available securely at every touchpoint—no need to aggravate customers by asking for information you’ve already captured elsewhere.

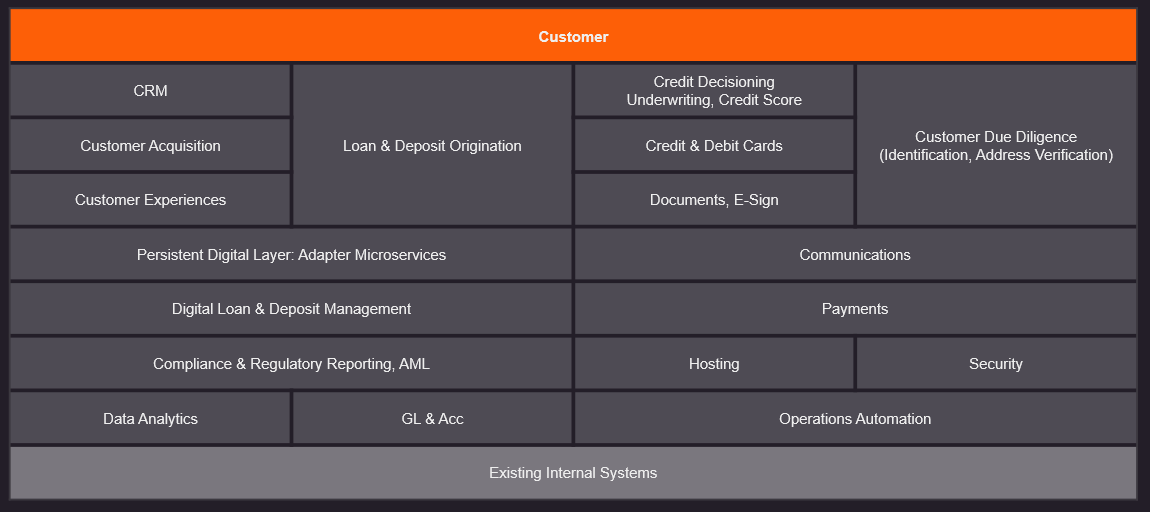

Digital Bank Mosaic: Representative View for Retail Banking

Real world results from around the world

Persistent Digital Bank and Credit Union Solution is a refined product of years of integrations and implementations in Europe, Asia, Africa, and North America—integrations that have delivered proven results for small- to mid-sized banks and credit unions, including:

- Faster throughput: One bank in Asia was able to reduce their loan rescheduling process from days to less than 90 seconds. Another bank in Europe reduced loan origination process time from weeks to less than a day.

- Increased agility and scalability: A bank in India processed more than 150,000 personal loans in one day around the Diwali holiday—more than most banks could hope to process in a full year!

- Fast integrations and time to value: A bank in Africa was able to rollout their digital banking solution in a matter of weeks, using Persistent’s pre-defined customer journeys and integrations to accelerate the initial development time.

If your bank or credit union is feeling the squeeze from the large multinationals on one side and the faster, nimbler fintechs on the other, it’s time to apply pressure on them instead.

Find out how a customized Persistent Digital Bank and Credit Union Solution can help you modernize and transform your banking operations from end to end, dramatically improve your customer experience, and begin seeing the benefits of your investment right away.