Introduction

In today’s digital age, the Internet of Things (IoT) is transforming the way we live and work. With IoT devices becoming increasingly integrated into our daily lives, it’s no surprise that they are also being used to facilitate financial transactions. IoT payments offer a convenient and secure way to process transactions between devices or between devices and humans. From smart homes to retail and healthcare industries, the possibilities for IoT payments are endless. In this blog, we’ll explore the world of IoT payments and delve into the benefits and challenges associated with this emerging technology.

What are IoT payments?

IoT payments are payment transactions triggered by IoT devices with a certain degree of autonomy, based on the data they collect and analyze. For instance, we would not consider a person using a mobile app to make an account-to-account bank transfer to be an example of an IoT payment. However, if the mobile phone uses its knowledge of the person’s location to trigger a payment automatically (with limited or no user interaction), then this would be considered an IoT payment.

Compared with other sectors, the payments industry is already highly automated and digitized, relying on the secure connection of millions of devices (such as payment terminals, contactless cards, cash machines and smartphones). With the advent of the IoT Payment Revolution, these payments will increasingly be triggered autonomously by machines.

IoT Payments Market size is projected to reach $5.4 trillion by 2028 from ~$155.53 billion (2021), growing at a CAGR of 66% globally

Trends driving the change

Payment ecosystem is witnessing the below major trends that are driving the IoT payment revolution.

- Acceleration of digital payments: Advances in payment technology, such as mobile wallets, contactless payments, and blockchain, are making it easier and more secure to process transactions using IoT devices.

Global mobile payment market is expected to grow at CAGR of 36% from 2023 to 2030.

- Massive growth in connected devices: The number of IoT devices is rapidly increasing, and with it, the potential for IoT payments. Smart home devices, wearables, and connected cars are just a few examples of the growing number of IoT devices that can facilitate financial transactions.

As per Statista, The number of connected IoT devices is expected to reach 75.4 billion by 2025, up from 26.7 billion in 2019

- The increased use of data-insights: IoT payments enable businesses to collect and analyze data about customer behavior, preferences, and spending habits, allowing for more targeted marketing and improved customer experiences.

Data analytics industry is expected to grow to $300 bn by 2030.

- Emerging markets and demographics:

- Urbanization: As more people move to cities, the demand for connected devices and IoT payments is increasing. Smart city initiatives are driving the development of IoT-enabled infrastructure, creating opportunities for IoT payments to be used in areas such as transportation, utilities, and public services.

- b. E-commerce: Rapid expansion of e-commerce in emerging markets – driven by the increasing availability of internet access and the growth of mobile devices. IoT payments offer a way to streamline the payment process, making it easier and more convenient for consumers to shop online.

Retail e-commerce sales is expected to reach $8.1 trillion by 2026.

Industry challenges

For autonomous payments to scale massively, people need to trust the device triggering a payment and the delegation of the person or organization accountable for the payment must be verifiable. Hence, regulatory frameworks will need to evolve rapidly to accommodate object-oriented transactions.

Here are the 3 key challenges:

- Security: In autonomous payments, the security risks associated with these devices become more significant as the payment gets processed from device without any manual intervention. A small vulnerability can allow hackers to steal credit card information from hundreds of customers. Enhanced security measures including biometric, fingerprints and tokenization might be needed.

- Regulatory issue: The lack of clear regulatory frameworks may create legal challenges and affect the adoption of IoT payments. E.g., some countries have strict data protection laws that require companies to obtain explicit consent from customers before collecting their data, which can affect the implementation of IoT payments in a connected ecosystem.

- Technical complexity: As the number of IoT devices deployed grows, managing and scaling the infrastructure to support these devices becomes a significant challenge. E.g., implementing IoT payments in retail industry requires deployment of payment terminals, mobile payment solutions and processing systems that can handle large volume of transactions.

Capitalizing on autonomous payments strategy is crucial for business growth as you need to respond quickly and at scale to keep up with the rising demands of your clients and strengthen your competitive position in the market. Creating IoT enabled solutions demands new competencies and lack of in-house expertise makes it costly and time consuming.

Cumulocity IoT Platform

Persistent Systems can help enterprises modernize their payments ecosystem with the help of best-in-class IoT enabled platform – Cumulocity IoT.

Cumulocity IoT platform is the only open and fully independent platform that enables you to connect to everything, run everywhere and integrate with any application. It helps to quickly develop IoT apps, analyze and leverage IoT data and run IoT at the edge on cloud or on-prem.

It is a single secure platform with Out-of-the-Box functionalities that ensures seamless integration with other systems and advanced analytic capabilities as well.

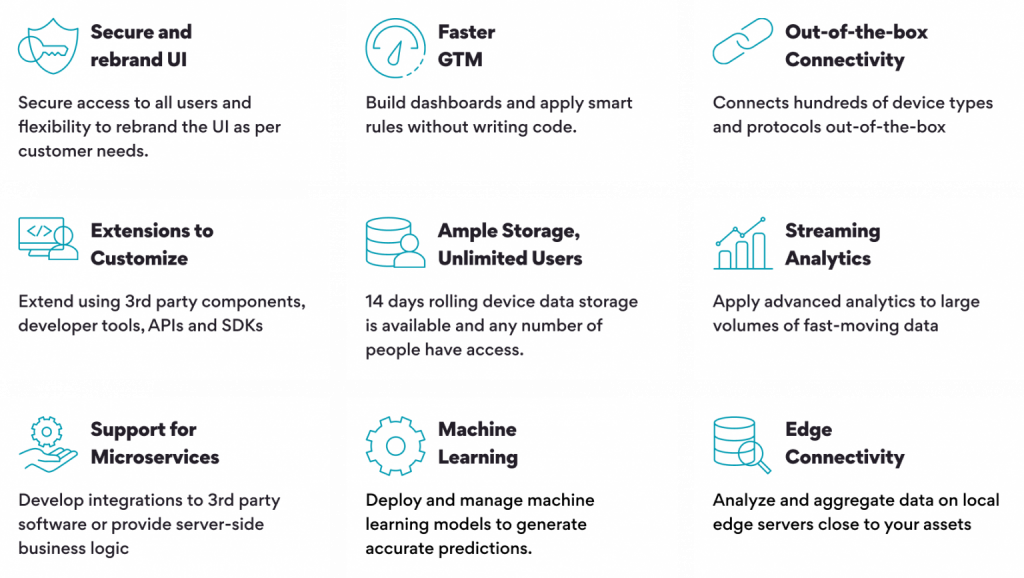

Our competitive differentiation that helps businesses navigate the complexity:

- It offers secure device management, data visualization and remote-control functionality through web. Out-of-the-box device connectivity to hundreds of devices and protocols.

- Flexibility to customize functionalities through real-time processing and applications.

- APIs for interfacing Cumulocity with other IT systems such as CRM or ERP.

- Cumulocity includes advanced analytics capabilities including Apama streaming analytics engine seamlessly integrated into platform.

- Cumulocity IoT natively provides capabilities for hybrid integration (webmethods.io).

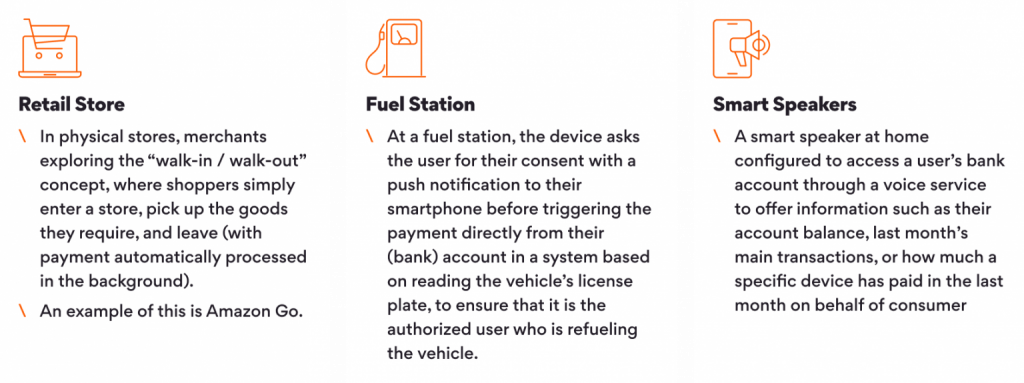

Business Use Cases

Conclusion

Businesses today are facing pressure to create new revenue streams to remain competitive. Lack of in-house expertise in IoT technologies makes sustenance of digital platforms costly and time consuming. You can count on us for getting the most out of your IoT investment as you accelerate business growth.

Learn how we partner with Software AG to help you drive innovation at speed and scale with the unmatched performance, reliability, and security of enterprise grade IoT platform.