CBDC is a digital form of fiat currency issued by the Central Bank. It is a direct liability of the Central Bank which does not allow for the intermediary digitization of currency by Commercial Banks. Currently, the disruptive financial services that offer an easier, faster, and cheaper mode of transaction have raised a serious concern that Central Banks may end up losing control over policies. This has further fuelled extensive research & innovation for Central Bank Digital Currency (CBDC).

According to CBDC tracker, as of March 2022, 80+ countries were exploring the issuance of digital currency, out of these, 17 countries have already launched/are running pilots. More information on the country-wise status for CBDCs can be found here.

In this blog, we will introduce you to CBDC and help you understand why this digital currency is touted as the ‘future of payments’.

In the current currency infrastructure, every citizen has a view of his/her holdings in the bank and can transact online by moving/investing funds. However, this digital form of currency is not issued by the Central Bank, hence, all disputes are handled by Commercial Banks who are involved in the transactions.

Cryptocurrency

Cryptocurrency is one of the fastest growing digital currencies that runs on the distributed ledger technology, however, it’s not issued by the Central Bank and is highly volatile in nature. Due to this, it is less effective to be used in a financial system that needs stability. To maintain minimum volatility, one can issue a stable coin which is generally pegged as 1:1 ratio, based on the reserved security.

Fungible and Non-fungible Tokens

CBDC can be modelled and distributed as Fungible or Non-fungible tokens. Fungible tokens make it easier to break the tokens and initiate mini to micro payments without having a third-party service tender small denominations. Whereas, Non-fungible tokens do not allow division of tokens for payments, which adds up to a service like ‘change maker’ which can help to exchange tokens for smaller denominations. This brings up a need of liquidity management to support the ‘change maker’ service.

The token ecosystem brings up a concept of digital wallets. A wallet is not the place where the tokens are stored, instead, it’s a virtual identity of the user which has a key pair corresponding to the address on the ledger which holds the tokens.

Wholesale and Retail CBDC

CBDCs can be broadly classified in two types – Wholesale and Retail CBDC. While Wholesale CBDC is primarily focused on financial institutes for e.g., holdings reserves at Central Bank, etc. Retail CBDC lays emphasis on consumers and businesses for day-to-day transactions like fiat currencies.

Retail CBDC can be further divided based on how individuals access their currencies i.e., ‘account based CBDC’ where they need digital identification or ‘token based CBDC’ where a key pair is generated, and the users can transact anonymously.

3 Types of CBDC Design Models

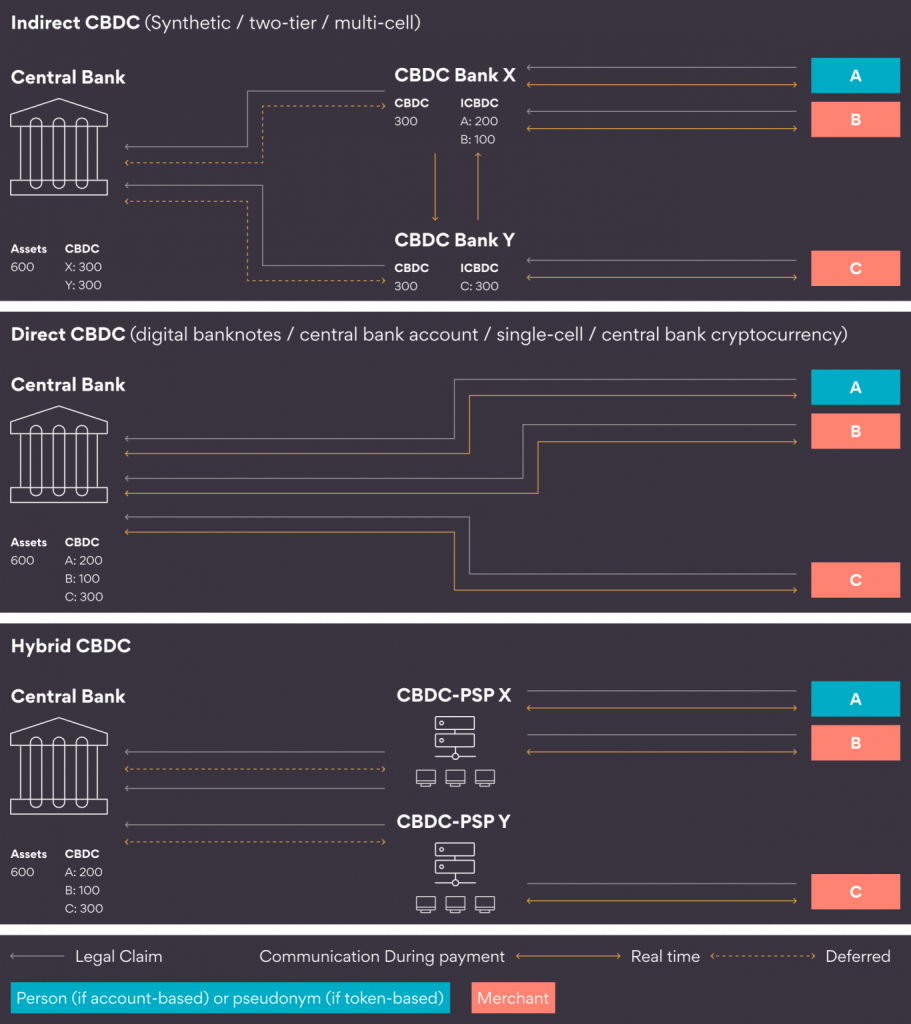

CBDCs are always issued by the Central Banks, however, their design models will change based on how they are accessed and claimed by consumers and businesses. The Bank for International Settlements (BIS) has listed three types of design models depending on these requirements:

#1 Indirect CBDC Model –

This model heavily relies on the intermediary banks to support consumers and businesses. Central Bank tracks holdings of each Commercial Bank which further supports the end-users. In this model, Central Bank manages the Wholesale payments, whereas Commercial Bank handles the Retail payments. For end users, CBDC is a direct claim on Commercial Banks that maintain the KYC checks.

#2 Direct CBDC Model –

It is controlled by the Central Bank. Each consumer or business will have a direct account with the Central Bank which helps to eliminate the intermediaries. All the Retail payment activities are handled by the Central Bank along with the CBDC claims and end-user KYC. Although this model is simpler to operate, it adds an extra overhead of running a KYC service for the Central Bank.

#3 Hybrid CBDC Model –

This model is a combination of both Indirect and Direct CBDC models. The Payment Service Providers (PSPs) manage the KYC and Retail payments. Whereas Central Bank periodically manages the balances for the end-users. This model provides a segregation of end-user balance sheet from PSP to Central Bank which helps to align a new PSPs in case of failure.

Image Source: Bank for International Settlements (BIS)

Advantages of CBDC

- Financial Inclusion: CBDC helps in promoting financial inclusion by creating an infrastructure which is affordable, accessible and secure to transact.

- Cashless Infrastructure: The shift from hard cash like paper notes or coins to digital currency will resolve the currency management overhead for individual and financial services.

- Effective Payment System: Creation of Escrows with different payment providers for transactions will be eliminated and replaced by faster settlements with zero credit risk.

- Cross Border Payments: CBDC will help in reducing the time taken for cross border payments by eliminating the intermediaries who add credit and settlement risks.

- Service Innovation: CBDC infrastructure will help financial services to innovate new solutions without relying on intermediaries for fund movements.

- Strengthening Policies: CBDC is denoted as a programable money which helps in enhancing governance and money movement policies.

Disadvantages of CBDC

- Shift to Financial System: CBDC will bring an infrastructure change in the financial system, this will affect the entire currency lifecycle from issuance to demonetization.

- Infrastructure Cost: Managing CBDC infrastructure will add cost to existing financial ecosystem as it needs to be resilient and available throughout.

- Resistance in Usage: CBDC will bring transaction traceability which makes it impossible for customers & businesses to transact anonymously, this brings in a resistance.

- Security: Programmability feature of digital currency can create an open environment for cyber risk.

- Interoperability: Current financial infrastructure needs to be interoperable with the innovation, this will call for changes in standards and governance polices.

Key Takeaways

- CBDC is a digital form of fiat currency issued and regulated by the Central Banks.

- Cryptocurrency is a type of currency which is volatile and not suitable for financial stability.

- CBDCs can be broadly classified as Wholesale and Retail CBDC based on the usage.

- Token ecosystem can be used to model CBDC as Fungible or Non-fungible digital assets.

- CBDC will provide faster, cheaper, and secure mode of transaction by eliminating intermediaries and credit risk.

At Persistent’s Innovation Labs, we have created Wholesale and Retail CBDC sandboxes as digital payment instruments. Click here if you want to know how ANZ Bank partnered with us to build an innovative Digital Currency solution for the Monetary Authority of Singapore (MAS) challenge. If you would like to leverage our Wholesale and Retail CBDC Sandboxes or know more about our offerings in Digital Payments and Currencies, reach out to us at blockchain@persistent.com