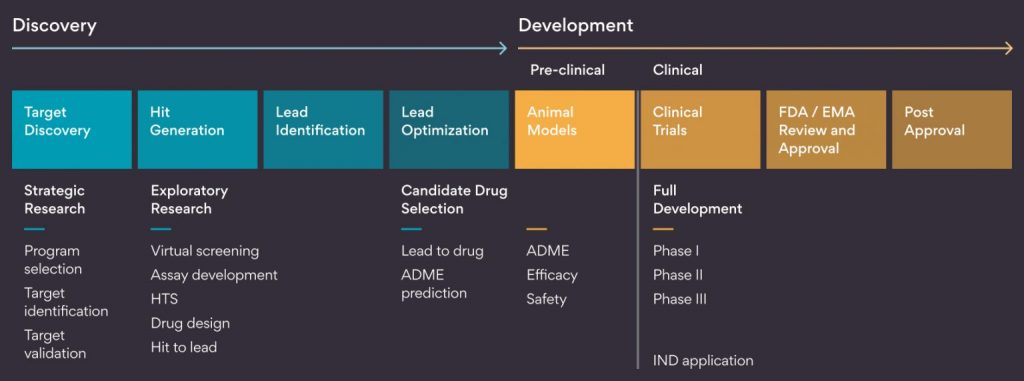

The Blockbuster drug model which once dominated the Pharma industry is now rapidly evolving into the precision medicine model. Here is a quick overview.

Blockbuster model philosophy: This entails that the new drugs should be developed for as many people as possible to achieve sales of at least 1bn USD. Reason: It is widely known that developing new drugs takes several years and billions of dollars as Pharma companies invest in clinical trials. To achieve a decent ROI, this model has worked very well in the past.

For instance, Pfizer’s best-selling drug ‘Lipitor’ (used for treatment of type 2 diabetes) generated a worldwide sale of ~14bn USD at its peak in 2006.

Precision medicine model: This is about customization and the target audience is smaller sub-population of patients e.g., Oncology. As the number of patients is less, it is difficult to build a product that delivers billion dollars of sales. Hence, the investment cycle and GTM is reduced is today’s world.

As per a McKinsey report, in 2019 35% of all compounds in visible pre-clinical pipeline were in oncology, up from 23% in 2000.

What are the key factors driving this growth?

Democratized innovation

As per GlobalData survey in 2022, 70% of Industry respondents anticipate ‘drug development’ to be the most impacted area by implementation of smart technologies.

- Tech-partnership — With the advent of new technologies and a collaborative ecosystem, drug commercialization life cycle has shortened.

For instance, US tech company NVIDIA launched Cambridge-1 (UK’s most powerful supercomputer) and announced partnerships with AstraZeneca and GSK to solve healthcare challenges.

- AI-accelerated drug discovery – Advancements in AI can help generate thousand more potential chemical compounds which has increased the opportunity to discover drugs by a million times. Also, Multimodal AI can help leverage health data from various sources to discover drugs or even personalize treatments.

- Investments — The level of VC investments has increased with Oncology experiencing 197 rounds of VC investment between 2009 and 2018. Academic partnerships have also helped the sector grow. Co-commercialization model is being adopted whereby Health-tech companies partner with Pharma companies and help them launch drugs more effectively and efficiently and in return get a percentage share of profits.

- Quantum computing – While still in infancy, industry players have acknowledged its potential to expedite medical research. In 2021, Roche announced a deal with Cambridge Quantum Computing to accelerate development of Alzheimer’s disease drugs.

Precision medicine

Oncology and Rare-diseases segment are at the forefront of Precision medicine. It involves leveraging data from multiple sources to provide more customized treatment.

- With an explosion of Big-data analytics, advancement in cancer biology (biomarkers) and genomics, precision medicine has grown at a rapid pace. Within this space, the number of biomarker-coupled therapies has increased by threefold since 2010.

- For instance, (CAR)-T Cell therapy – genetically alters immune cells called T cells (specific to an individual) to fight the cancer cells more effectively.

- Another instance is Gene editing – It’s a group of technologies that allows genetic material to be altered to fight the disease. A well-known technology for genome editing is CRISPR.

Patient centric approach

Decentralization can be considered the epitome of ‘patient-focused’ approach to clinical trial design. Decentralized Clinical trials are executed remotely through telemedicine and mobile/local healthcare providers. They help in reducing the time and cost it takes to participate, easing the burden on participants and delivering efficiency.

- Covid-19 has expedited drug launches in ways that is going to continue for future. It has also catalyzed the adoption of decentralized trials improving the patient and physician experience. Improving patient experiences/engagement is a key differentiator in drug development timelines.

- Decentralization also broadens access to a larger number and potentially a more diverse pool of patients and hence helps in improving the efficacy of drug launches.

Why drug launches miss market expectations and how to fix it?

With growing costs of developing new drugs and shortened times to peak sales, successful drug launches are getting increasingly difficult. As per a study by Deloitte, 36% of novel drugs (FDA approved) launched in US between 2012 and 2017 failed to meet market expectation in the first year.

Three most common reasons for missing expectations are:

- Limited market access (lack of coverage, expense planning etc)

- Inadequate market understanding (Underestimating difficulty of converting prescribers and patients from existing therapies)

- Poor product differentiation (Branding, launch strategy or product proposition is not compelling enough)

Thus, a successful launch strategy is crucial to survive and stay ahead in the market. While Pharma companies may not be able to control every aspect of a launch, many of the potential failure points can be mitigated by collaboration with a Technology partner.

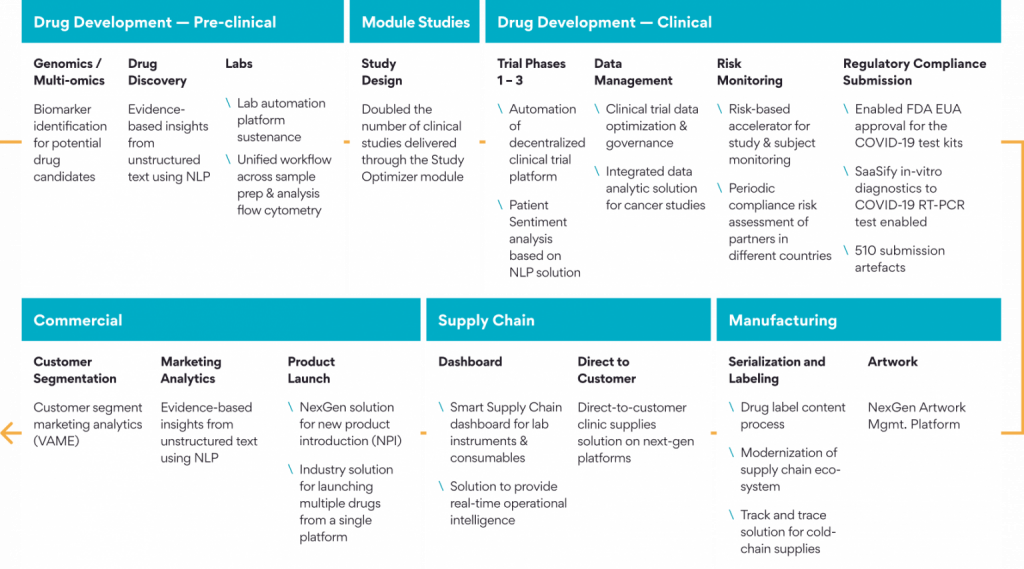

We at Persistent, through our technology and Industry expertise can help Pharma and Lifesciences organizations streamline various aspects of the value chain.

How Persistent can help optimize the commercial value chain in drug lifecycle?

Data is the key

We help organizations get actionable insights from data generated at various stages – that being the single most important factor for success. In other words – Effective content utilization.

- Data is generated in every phase right from discovery, trials, medical and regulatory phase.

- Real-world data (RWD) related to patient health status such as EHRs, EMRs.

- Data regarding ecosystem involving Payers, HCPs, Physicians, etc.

Here is a Persistent’s Story of a Drug- Powering the End-to-End Life Cycle

Persistent has served the Life Science and Healthcare industry for 25+ years. Our robust technology Centers of Excellence provide solutions across the entire Pharma value chain from Drug Discovery to Distribution.

Learn more about Persistent Solutions for Pharmaceuticals & CROs : Click Here