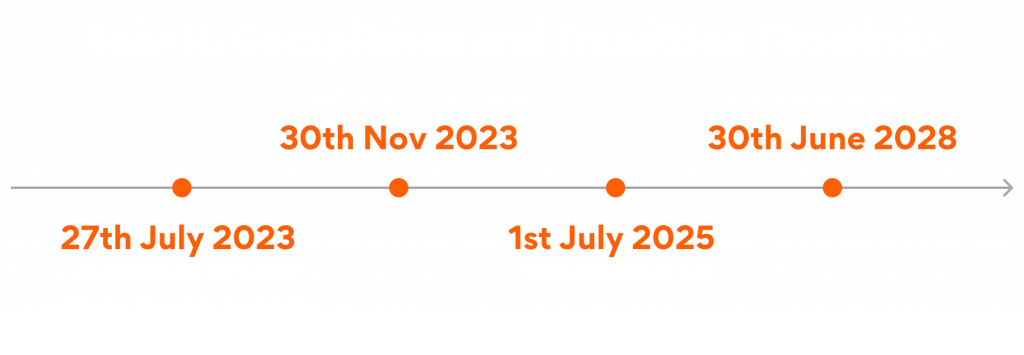

The Basel III Endgame (B3E) decisions announced in July 2023 marked a significant turning point in the global finance industry. The proposal, impacting financial institutions with $100 billion or more in total assets, mandates more stringent criteria for regional and mid-sized institutions, altering the perspective of large banks on regulatory capital. This decision is most likely to impact their liquidity, risk, and overall banking operations significantly. The Expanded Risk-Based Approach (ERBA) is expected to increase Risk-Weighted Assets (RWA), necessitating a boost in the Stress Capital Buffer (SCB) and emphasising capital allocation and risk-return efficiencies.

However, the conversation about efficiency is incomplete without technology. Financial institutions have a triple requirement now to proficiently leverage technology in managing Credit, Market, and Operational risks. This approach to risk management will significantly impact day-to-day operations, influencing both revenue and profits.

How technology will enable banks to address Basel III Endgame (B3E)

Beyond capital requirements, B3E influences the IT and data requirements of large institutions in a substantial way. Basel III compliance requires a special focus on data acquisition by refining risk models using data from multiple sources. All large banks and financial institutions must focus on improving review and documentation processes, tracking operational loss event data, and developing feedback loops for model enhancement as critical first steps. It is imperative for them to implement checks and balances to understand the factors that contribute to operational data losses since Basel requires an operational risk function with frequent audits. The evaluation of customer risk profiles for credit limit extensions and the implementation of risk-based pricing for Loan To Value (LTV) transparency are critically important as well. Finally, the strategy will be concluded with an exhaustive reevaluation and recalibration of operational metrics.

On the data side, managing and processing large volumes of data as well as modifying existing models require considerable effort. This data is stored on top of the infrastructure, thereby increasing consumption. Accessing and managing this data to improve models and implementing tactical or strategic measures based on the current data condition of the bank presents a challenge for CIOs and CTOs. It is critical to identify data elements for RWA calculations, including those that are unused, new, or uncaptured. Furthermore, conducting an in-depth analysis of data sources and processes, including ingestion, transformation, and storage becomes important as well. The change may have an impact on existing configurations, requiring modifications to pipelines and Extract, Transform, and Load (ETL) procedures.

Infrastructure, analytics, and reporting are all impacted by increased data processing, which necessitates robust data governance. Conducting a current assessment will become vital to developing an accurate regulatory strategy and ensuring preparedness for upcoming challenges. Furthermore, given the short time frame, large banks must account for good product management that combines multiple streams.

How Persistent can help you sail seamlessly through Basel III Endgame (B3E)

Given the global diversity in industries, having access to local data sources becomes critical. For example, financial institutions operating in regions such as Europe are obligated to adhere to specific regional compliance standards pertaining to anti-money laundering (AML) and liquidity. These standards encompass a range of protocols such as CSDR, ESG, CMAR, CAR, SRD II, AML5D, AML6D, Swiss FSA, CSDR, Depositor protection, and the Swiss FSA. Additionally, it is also critical for cloud-native infrastructures to optimise their cloud expenditures in accordance with GDPR and other regulatory requirements.

With financial institutions operating different business models in different countries, assessing risk becomes even more challenging. Understanding such technical nuances requires expertise, and demands a product-centric approach rather than a traditional engineering approach. Persistent, with its deep technology expertise and a broad partner ecosystem, offers data management and cataloguing solutions to such large financial institutions. Our purpose-built business solutions and accelerators deliver results three times faster than custom integrations. Additionally, our retail banking solutions have empowered many financial institutions to swiftly develop new digital services and replace legacy systems.

Persistent is all geared up to help large financial institutions address the imminent technological challenges in light of B3E. In fact, we’re already working with a global institution to help it expand its capabilities.

The Basel III Endgame offers all the global financial giants a lucrative opportunity to initiate constructive transformation. By embracing the Basel regulations, financial institutions will be able to take a technological leap forward, thereby increasing the dynamism of their operations. This shift will also fast-track the elimination of legacy systems that otherwise become a barrier to their progress and productivity. Financial institutions can strategically position themselves to adopt modernisation, optimise processes, and strengthen overall resilience by utilising the Basel III Endgame framework.

Persistent’s data and compliance expertise is helping financial institutions with a smooth regulatory transition. Connect with us to learn more.

Author’s Profile

Devashish Mishra

Solutions Head, Europe