Payment transactions are not just about transferring money. They play a crucial role in providing a great customer experience (CX). Most businesses prioritize CX as a driving force for their strategies. Tech-savvy customers today demand innovative solutions for their daily needs, such as buying groceries, paying bills, and transferring money to friends. Cashless options such as QR codes, request-for-pay links, and digital wallets have made our lives easier. However, there is still a need for more innovative solutions to keep customers happy and interested.

Connected vehicles are a recent innovation in the automotive finance industry. They are smart, internet-enabled vehicles that offer advanced features that enhance customer experience. These vehicles are leading us to an era of in-car payments or Machine-to-Machine (M2M) Payments, which enable customers to pay bills or make purchases without opening their digital wallets or logging into a mobile app. FASTag implementation in India is a good example of such payments, wherein one doesn’t need to exchange cash or provide a credit/debit card to pay for tolls on highways. This payment system adds convenience for customers and ensures their safety by avoiding accidents caused due to mobile phone usage while driving.

The Global Automotive In-Vehicle Payment market size, valued at $4.33 Billion in 2023, is expected to grow at a CAGR of 16% from 2024 to 2030, reaching nearly $12.39 Billion in 2030.

Key Use Cases for Connected Payments

Connected payments, i.e. in-vehicle payments, imply making payments using a vehicle without any dependency on external entities like smartphones, cards, or cash. Original Equipment Manufacturers (OEMs) in the automotive industry are extending these payment features into the vehicle dashboards for the following use cases:

- Automatic toll collection on freeways and highways

- Automatic payment for smart parking hubs

- Payment for fuel in petrol/diesel/gas/e-charging stations

- Paying for car wash/car-servicing at the service centers

- Payment for food and beverages at drive-ins/takeaways

- Instant Account-to-Account (A2A) / Person-to-Person (P2P) payments for peer payments

- Online payments for on-the-go shopping experiences

Current Payment Trends in Automotive Finance

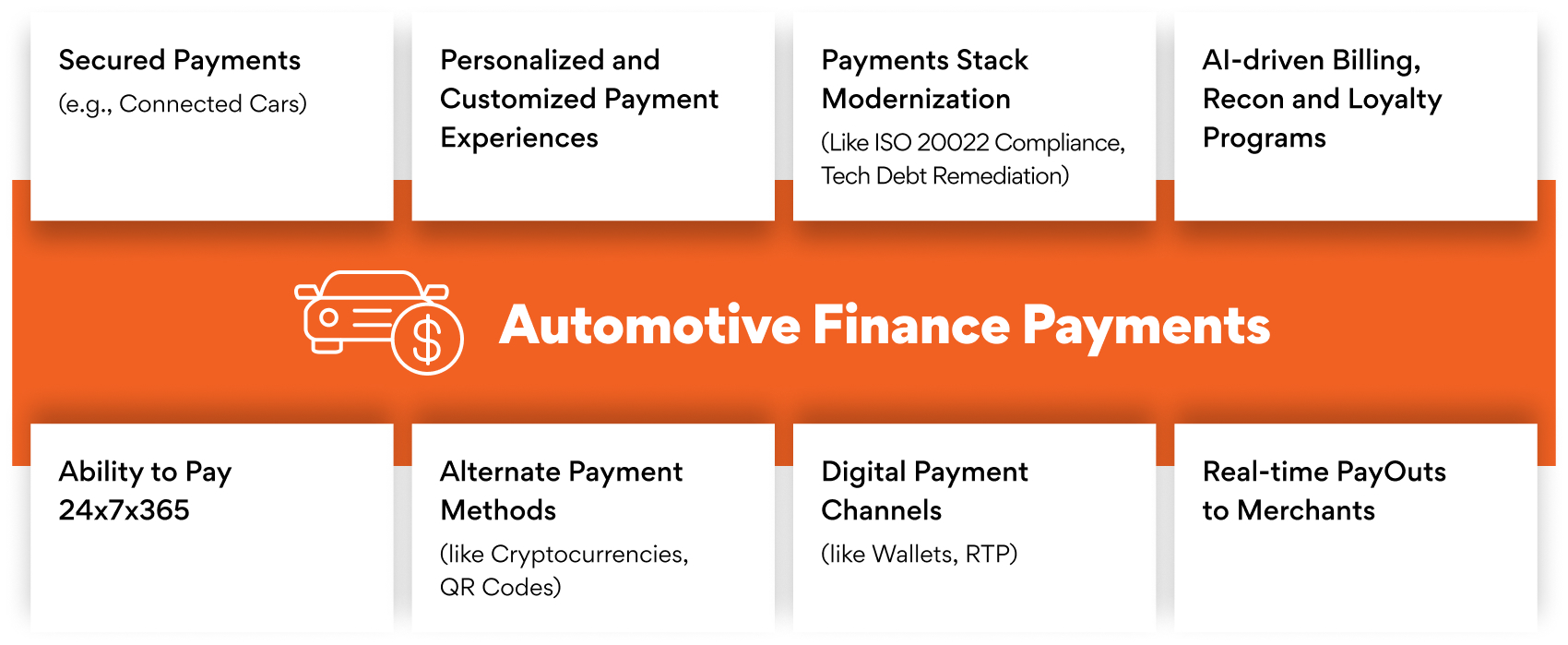

The automotive finance industry is developing new in-vehicle payment methods to meet modern customers’ demands for instant and flexible payments, as depicted in Figure 1.

AI-driven customized offerings are also being developed for additional value. However, automobile manufacturers need to modernize their tech stack and invest in a platform that can deliver short and long-term benefits to make these innovations a reality.

Technology for Enabling M2M Payments

Vehicles can be transformed into a M2M payment channel, through several ways leveraging various technologies:

- Radio Frequency Identification (RFID) tags: This mechanism uses short range radio frequency signals to capture tag details by collecting data over-the-air and does not require any internet connectivity.

- Bluetooth Low Energy (BLE) modules: A wireless mode of connectivity requiring an expensive power system with its own operating system. BLE offers longer communication range than RFID tags, resulting in a lower payment failure ratio.

- Application Programming Interfaces (APIs): These are the most advanced and safest method of making in-car payments, but it requires special hardware and software set-up and may only be implemented in high-end cars.

- Internet-of-Things (IoT): As vehicles are in motion, the transfer of data between vehicles and backend payment systems requires IoT frameworks to publish real-time telemetry data/events. These frameworks ensure that connected vehicles are connected to the payment processing layer.

- 5G Communication: The 5th -generation (5G) wireless communication technology is critical for real-time M2M payments. 5G’s low latency, enhanced security, high transfer speeds, and increased network capacity to support IoT data from smart vehicles, making real-time in-vehicle payments more convenient. 5G also analyzes data in near real-time to detect fraud, simplify payment initiation, and provide hyper-personalized recommendations.

- Biometric Authentication: To secure against authorized payments, biometric authentication such as iris/facial scan, voice-enabled systems, or fingerprint sensors need to be included in a vehicle to verify the authenticity of the individual triggering the payment.

- Tokenization Frameworks: For secure payment processing, sensitive payment details like card numbers must be encrypted during transmission and storage. Tokenization frameworks from banks or payment networks need to be integrated into vehicles to achieve this.

Fortune Business Insights reports that credit/debit cards, digital wallets, RFID and QR codes are the main payment modes used for in-vehicle payments. Credit/debit cards are the most used payment method, while digital wallets store tokenized card details and eliminate the need for physical cards. RFID and QR codes are fast and flexible, making them of the preferred payment modes for toll booths and parking spaces.

Key Challenges for M2M payments

Every innovation brings new challenges. As M2M payment innovations for vehicles continue, some of the most urgent ones include:

- Security: As Payments involve sensitive information like personal and financial details, OEMs must set up proper frameworks to protect user data from cyberthreats. Data encryption (at-rest and in-motion) using cryptography, card tokenization, biometric and multi-factor authentications can enable secure connected payments.

- Compliance: Payments are highly regulated, and the M2M Payments solutions must abide by compliance requirements of all applicable laws and regulations in each state, county, region, and country.

- Cost: Vehicle manufacturers must make initial investments in R&D, market analysis, hardware/software development, and testing cycles before deploying connected payment solutions in their vehicles.

- User Mindset: Training users and drivers to rely on in-vehicle payment modes is challenging as some still prefer using their mobile phones. This requires educating users on the potential benefits of in-vehicle payments.

In-vehicle or connected payments will continue to gain momentum, leading to more advanced use cases, business models, and OEM revenue streams. OEMs need a robust, well-architected payments processing layer at the backend, integrated with technology pillars like IoT, AI, Machine Learning, Distributed Ledgers, etc.

With deep technology expertise and 32+ years of experience in implementing and modernizing payment solutions, Persistent is a trusted partner for financial institutions and merchants worldwide. We can help OEMs or vehicle manufacturers innovate in the connected payments market by utilizing our vast partner ecosystem of PSPs (Payment Service Providers) and Fintechs.

Learn more about our Payment Solutions.

Author’s Profile

Pooja Arora

Senior Architect, BFSI Payment