The economic impact of the COVID-19 pandemic has left businesses across the globe reeling, however as the economy combats the reverberations of the global slowdown, the financial institutions need a radical shift in their approach to support the most important pillar of the economy. In the post covid world, SME lending will be not only economically significant but also one of the most profitable contributors to banking revenues. According to a World Bank report, the world’s small and medium-size enterprises (SMEs) have unmet finance needs of approximately $5.2 trillion yearly.

Banks can take advantage of new opportunities with SMEs and capture more of the forecast growth by reimagining and modernizing their business-lending processes. However, banks are finding challenges in the SME lending market because many banks still use old business models, rely on legacy processes, and view SMEs as corporate entities. By failing to meet the needs of these businesses, banks are leaving opportunities on the table for the new age fintech companies.

According to McKinsey, re-envisioning SME lending can have a significant impact on the operating numbers of banks, such as:

- 10 to 15 percent revenue boost through higher conversion rates.

- Operational-efficiency gains of 20 to 30 percent with the help of digitizing the customer journey and touch-time reductions.

- 10 to 25 percent reduced risk of nonperforming loans (NPLs) by enhancing risk models and making automated decisions using analytics.

Before diving into how to solve the lending problem for SMEs, let us explore the current challenges in the SME lending market:

- Unavailability of credit ratings for small and medium enterprises as low value transactions done by these enterprises go unnoticed by large banks.

- Excessive risk associated with SME lending as banks find it inefficient to execute extensive risk assessments for small loans.

- Higher operating cost and default risk raises interest rates for SMEs which makes lending non-lucrative for small businesses.

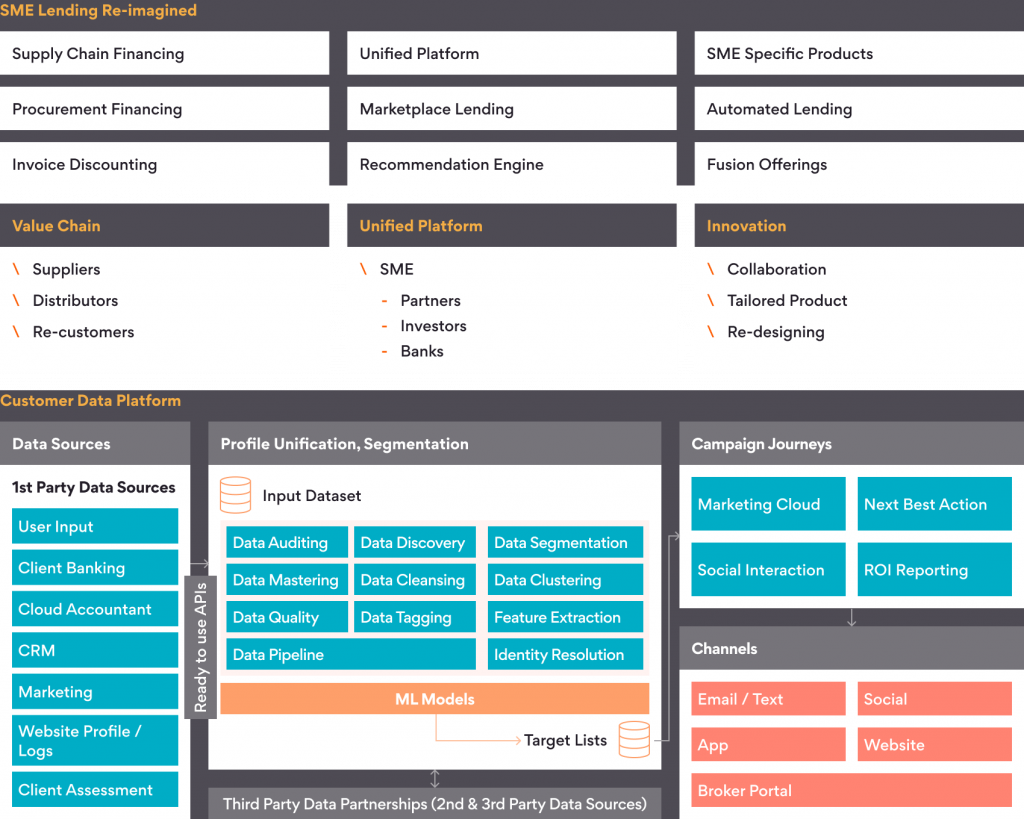

Digital technology can help the financial institutions overcome these challenges. The below architecture covers possible scenarios which can reduce bank’s lending risk and could turn out to be win-win situation for banks as well as SMEs.

Deliberating on each scenario stated above in detail.

- Create a Marketplace Lending Platform: Building a multi-sided platform can offer both SMEs and the platform partners the right business opportunities. A unified data platform with 360° view of the customer along with an AI based recommendation engine with power to provide actionable insights can help the lenders perform efficient customer segmentation and offer hyper-personalization of products to the target segment. The marketplace platform has the potential to become a one stop solution for all SMEs as it can connect relevant business opportunities to appropriate institutions who are truly interested in lending to SMEs.

- Supply Chain Financing: Large enterprise purchases processed raw material, components, etc from SMEs, therefore banks can either provide procurement financing based on purchase orders or offer invoice discounting lending model wherein banks get money directly from large enterprises once the order is completed. This can significantly reduce the risk of non-performing loans for the banks. FinTechs such as Muse Finance and Finverity are operating in supply chain financing space to make credit easily accessible to SMEs.

- AI based Recommendation Engine: Automated risk assessment models can help the banks identify credit worthiness and repayment tenures for different types of businesses across offered product types. These automated models will reduce the cost associated with risk assessment even for small loans. The input data source for the recommendation engine may comprise of:

- Operating numbers of SMEs such as Account receivables, Account payables, Sales, Recurring Revenue, Net Working Capital.

- Financial History from previous year tax returns, bank account statements.

- Business assets that the SMEs possesses.

- Behavioural patterns through reviews & ratings on social media and identifying large transactions from bank statements.

- Build SME specific products: Banks should try to reimagine lending to SMEs from the perspective of the target customer. Extensive understanding of the pain points that the SMEs experience will help the bank create tailored product and service offerings which will be more beneficial for the target community. For example, the most common pain point for the SME borrowers globally is uncertainty and delayed time to funding. Automated lending can significantly streamline processes and offer faster loan processing.

- Fusion offerings: Collaborating with other financial products can help create curated offerings for the SME segment. One such offering is to club lending with insurance. Bringing together these two product offerings can help to reduce the risk associated with SME lending, however the associated downside with this offering is that the higher rate of interest (due to associated cost of insurance) will make the loan non-lucrative for end customer.

To summarize, the SME lending landscape is changing rapidly and the situation demands a shift towards digital offerings. Currently, FinTechs are leading the change by innovating and delivering alternative lending solutions. However large traditional lenders, who carry the long-term advantage in this highly regulated space, can become a frontrunner in digital lending by transforming their business processes.

One such traditional credit union based in the UK saw challenges as well as opportunities in the lending market due to changing customer behavior and fintech disruption. The credit union capitalized on the new opportunities by redesigning their core banking IT. Persistent Systems helped the lender become a pure play digital player by redesigning the end-to-end loan processing journey and migration to a cloud-based platform.

The fully-digital lending platform offered instant decisions which reduced loan application time to just 5 mins. It enjoyed immense customer growth and disbursed 100% more loans to their customers. The seamless customer experience helped reduce the loan processing time by 50% and further provided 50% reduction in document retrieval time. The digital journey helped the lender become one of the top 5 credit unions in the United Kingdom.