As the market grows increasingly competitive, financial institutions around the globe recognize the importance of investing in a digital future to foster innovation, drive profitability and ensure long-term success in an ever-evolving landscape. Customised platform builds and data assets are enhancing banking experiences as the banking industry is undergoing substantial changes and is consistently innovating to provide state-of-the-art products and services to attract customers. Increasing focus on customer experience, quicker service and improved profitability has led to financial institutions investing in a digital ecosystem to simplify daily banking and access to credit.

Access to credit and financing has always been a key service offering for revenue generation and competitive differentiation. These offerings play a crucial role in generating revenue streams and increasing profits. It boosts interest earnings, attracts new customers, and creates more unique opportunities for the economy to thrive. Studies show that consumer lending in the UK reached nearly 30 billion GBP in mid 2023, excluding student loans.

Customers are demanding more control, faster loan approvals and personalised finance management tools to monitor and manage their money. Companies leverage technology to revolutionise lending and execute strategies focusedon digitally transforming business with tech, data, automation, and artificial intelligence (AI). Customised platform builds, data assets and AI-powered solutions are used to personalize experiences and automate cross-selling of services.

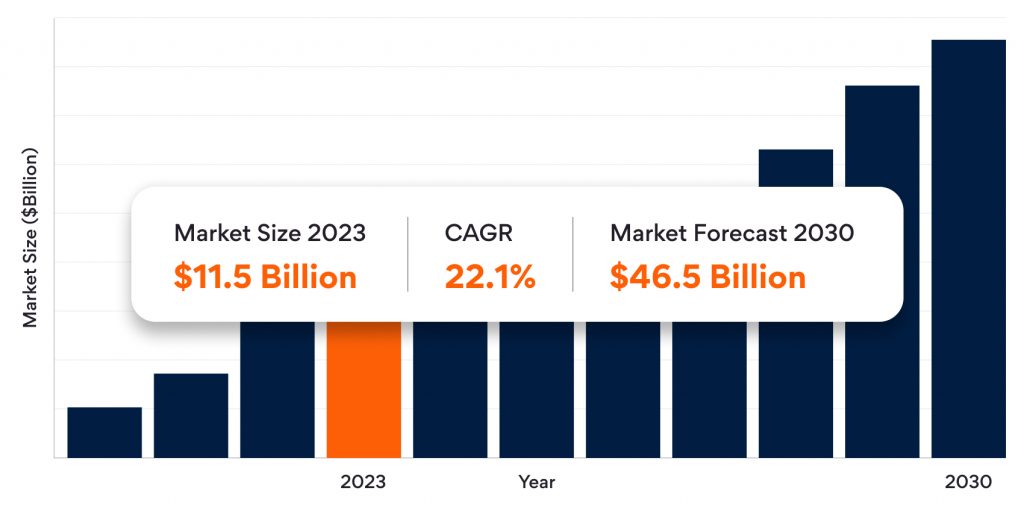

Advancements in innovation, computing and storage are transforming capabilities across the digital lending value chain. As a result, lending has seen a rapid emergence of digital lending platforms, and the market, valued at $11.5 billion in 2023, is expected to grow at a compound annual growth rate (CAGR) of 22.1%.

It’s all about understanding customer demands and simplifying access to credit.

As the lending industry undergoes digital transformation, it is essential to maintain an alignment with business objectives and focus on factors which will help you achieve your objective key results (ORKs) in line with your commitments to customers and shareholders.

Lending in any format is a revenue-generating stream and organisations are focused on enhancing capabilities and continuing to invest in a digital future. Businesses must keep customer experience and data at the core. This enables innovation to meet demanding customers across Retail, Small Business Enterprises and Commercial sectors. Embed Buy-Now-Pay-Later offerings into daily banking solutions and provide Personal Finance Management Tools to manage money better.

An optimised lending process not only ensures hassle-free access to credit and customer convenience but also drives growth. Studies suggest 26% of SMEs indicate they would be willing to pay for access to faster credit.

Persistent digital lending solution accelerates go-to-market with a ready-to-deploy proposition into existing product and service offerings. Our solution automates and digitises lending management from customer acquisition, risk scoring, credit checks, underwriting, electronic signatures, and disbursement to customised customer support and loan servicing using low-code-no-code (LCNC) platform.

With our capability to innovate existing offerings and digitise experience across engagement channels, Persistent brings to market a solution accelerator that can embed personal and consumer finance as a service on top of existing architectures. Our solution tenets cover operating model dimensions to provide solutions that transform digital lending.

- Customer – Simplified lending, 100% paperless and 100% digital by design. Automated processes AI / data-driven credit decisioning with instant disbursements, channel optimisation and contact strategies.

- Experience – An omnichannel experience regardless of the channel. 100% transparency on key lending stages with a dashboard tracking progress from application to disbursement.

- Architecture – An interoperable solution design, which is scalable and secure in line with regional banking regulations. Our solution blueprint can be replicated for BNPL and other cash and credit services.

- Technology – A LCNC solution, scalable and with automation capabilities to update system of records. Integrated back-end rules engine aligned to business and credit risk policy guidelines.

- Data – A customer 360-degree view for effective preference management. AI-driven underwriting and risk management.

- Risk Management – 100% secure and aligned to regional banking, data and conduct policies.

- Governance – 100% auditable and compliant with internal policies and external regulatory protocols.

We can help you innovate existing offerings and digitise experience across engagement channels. If you are interested in understanding how we do it and want to see a demo or our digital lending service offering, contact us today.

Author’s Profile

Neh Yadav

Principal, Strategy and Growth