Property & Casualty (P&C) insurers confront a plethora of challenges in terms of changing consumer behaviors, intensifying competition, and disruptive technologies. Environmental uncertainty also adds turbulence to insurers’ ability to predict losses from catastrophic events.

Is it time for P&C insurers to re-think their business models to secure sustainable advantage in the coming years? InsurTechs and many non-traditional P&C insurance firms are already transforming their portfolio to Usage-based Insurance (UBI) products to enhance customer engagement and provide value-added services. In this context, we predict a transformative role change for P&C insurers to stay relevant.

As smart home devices become ubiquitous, UBI goes mainstream presenting considerable opportunities to P&C insurers. To reinvent customer engagement and reduce losses, P&C Insurers can employ an IoT-based connected ecosystem and be a proactive preventer of risks and partner in Insured lives. With connected devices, P&C Insurers can understand user behavior at a granular level, allowing them to offer personalized policies, currently impossible today.

For example, imagine a home insurer proactively warning a customer of abnormal water levels or electrical outages due to an impending weather event that could lead to equipment failures. Based on a granular risk review, a home insurer can leverage the collected data to personalize coverage with premiums. Further, it can offer customers a risk assessment by providing sophisticated usage and risk data about weather conditions and incentivize users for their safer behavior.

With our connected home sensors, we notify homeowners of potential water leaks, thereby minimizing and even avoiding costly claims completely. With a connected insurance ecosystem, insured customers can also be prompted to make suitable maintenance appointments to avoid breakdowns.

The insured can gain from quicker claim resolution due to transparent and automated processes, hyper-personalized offerings, and constant risk updates through proactive alerts. For insurers, the ecosystem can provide immediate First Notice of Loss (FNOL) warnings and insight into the cause and severity of the loss, significantly reducing a customer’s claim-assessment time and improving the overall underwriting process. It also ensures greater customer-centricity in offerings, increased brand loyalty, customer churn reduction, and more.

P&C insurers can evolve their offerings in an ecosystem and monetize from their network of suppliers by penetrating adjacent industries. The key business imperative will be to extend the non-insurance services offering through the activation of cross-industry distributed partnerships. Insurers can lease their expertise of experienced adjusters to Banking, Mortgage services, Real estate services, or foray into property management solutions. Without doubt this new, connected insurance ecosystem is going to dominate the P&C insurance space.

Research also indicates that more and more policyholders are willing to share real-time data for risk control and prevention services in return for incentives, cashback, or discounts on premiums.

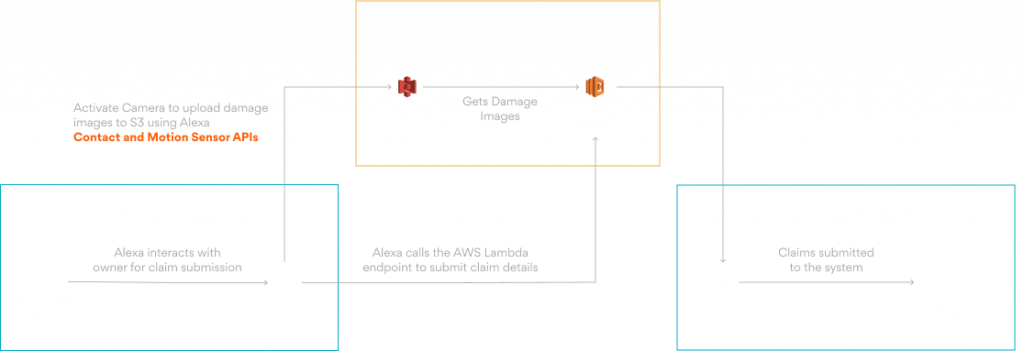

As an example, above is our smart homes-connected insurance solution accelerator where we have integrated Amazon Alexa/Echo with smart home sensors in a cloud-native environment. Smart home sensors provide insurers with sophisticated usage and risk data stored on the cloud. In-home active cameras capture contents in the home, enabling quicker and easier filing of claims. The gathered data enables new proactive services through early risk intervention, empowering P&C insurers to offer hyper-personalized products.

1 Source: Statista- Smart Home

The landscape of Insurance is changing rapidly, making the digital transformation shifts essential.

At Persistent Systems, we help P&C insurance firms to bring about this transformation. Our connected insurance offerings span automobile, home, health, and industrial insurance and are already transforming insurers to be the next generation of risk-management partners.

Learn more about our Digital Insurance capabilities.