The banking and financial services (BFS) ecosystem has witnessed a paradigm shift due to significant technology advancements such as increased usage of AI/ML, blockchain powered ecosystems, hyper-automation and growing bank-fintech partnerships. Among the various segments of the financial services industry, payments have been the most heavily invested area within Fintech. According to the annual BCG report, global payments revenues are expected to reach $3.3 trillion by 2031.

The BFS industry is currently witnessing several critical trends, such as real-time payments, cross-border interoperability, embedded finance, financial crime and fraud prevention, and Payments-as-a-Service (PaaS), which are shaping its future direction. As these trends profoundly impact the financial industry, they must be acknowledged and understood to stay ahead of the competition.

- Real-time payments

The adoption of real-time payments (RTPs) has surged worldwide owing to the growing preference of consumers for instant payment solutions and the significant technological advancements that have taken place. The continued digitization of economies and the increasing number of e-commerce startups globally have also contributed to the growth of RTPs.

The global real-time payments market is expected to reach $99.7 Bn by 2028 growing at CAGR of 33% from 2021 to 2028.

- Cross-border Interoperability (ISO20022)

The use of different messaging standards, such as SWIFT MT, ISO8583, ISO15022, etc. has resulted in interoperability issues, particularly in cross-border payments. Communication between these systems has become complex and delayed, causing significant challenges to businesses. This has led to the introduction of ISO20022, a messaging standard based on Open technology framework that aims to simplify communication between different payment systems by creating a common model and language for payments data across the globe.

ISO 20022 is expected to play a crucial role in the innovation and modernization of the payments sector. It captures business transactions in a ‘syntax independent’ approach, which leads to

- Enhanced Customer Experience: Enables accurate innovation and supports automation granularity, thereby leading to faster real-time payments.

- Standardization: Single payment can describe multiple instructions. Receiving data like payment invoices in remittance information to get context of payments is the most common use case.

- Risk and Compliance: Easy to combat financial crime and implement risk modeling.

- Productivity: Induces supply chain and working capital efficiency by virtue of a standardized format.

By 2023, ISO 20022 will account for 80% of volumes of high value transactions.

- Embedded finance

Embedded finance is all about integrating financial services like lending, payment processing, or insurance into the infrastructures of non-financial businesses. This integration has gained significant traction, as it adds value and enhances customer targeting for non-financial companies that offer financial products and services. The most commonly used embedded finance services include integrated insurance services, BNPL services, etc.

Embedded financing is expected to generate $230 billion in revenue by 2025

- Financial crime and fraud prevention

With the advent of crypto-currencies and newer financial instruments, regulatory bodies across the globe have intensified their efforts to ensure security and compliance within the industry. This has led to the implementation of various policies and measures such as the General Data Protection Regulation (GDPR), Revised Payment Services Directive (PSD2), Digital Operational Resilience Act (DORA), and Markets in Crypto-assets Regulation (MiCA) that will have a significant impact on the payments sector.

Global fraud detection and prevention market is expected to grow to $129 billion USD in 2029, exhibiting a CAGR of 22.8%

- Payments-as-a-Service

Payments-as-a-Service (PaaS) is essentially outsourcing of payment solutions or products to other players in the industry. Few examples of PaaS would be – KYC/AML facility, cyber-security products, payment processing engines, reconciliation, and settlement, etc. This allows banks and fintech players to innovate and launch financial products quickly to the market without spending too much time on internal development of the product from scratch.

Global PaaS market size is projected to reach $25.7 billion by 2027.

Key Industry Challenges

To keep pace with these industry trends, financial institutions need to quickly transform their payments platforms and operating models. In doing so, they face the following challenges:

- Duplicate payment engines/processes due to legacy systems or acquisitions, leading to inefficiencies;

- Need for continuous monitoring of transactions from a central Hub;

- Adherence to changing regulations and compliance (such as GDPR, PSD2, DORA, etc.) across borders;

- Handling multiple payment channels and integrating with payment systems built with different technology/message formats/protocols;

- Need for massive vertical and horizontal scaling to accommodate unpredictable workloads.

How to address these challenges?

Informed CTOs and CIOs can embrace this opportunity to deploy a high-performance payment processing solution that supports all payment types, ranging from immediate payment schemes to traditional ones, including ACH, SEPA, SWIFT and Check by partnering with a technology provider.

Value proposition: Persistent offers a proven path to growth

IBM FTM (Financial Transaction Manager) is one such suite of product offerings that helps banks and financial institutions drive agility and modernization. IBM FTM offers the following features:

- Enables seamless migration to ISO20022 and real-time processing to handle up to 9000 transactions per second;

- Helps converge payment operations on a single unified payment hub, thereby reducing the implementation time, operational risk, and costs;

- Enables predictive insights and customer reporting. Also shortens go-to-market (GTM) for services such as real-time fraud detection;

- Establishes a payment infrastructure to keep pace with regulatory and compliance mandates.

Success Stories

Business Use Case: A leading Canadian Bank created a centralized future-ready payments hub, enabling a shorter GTM.

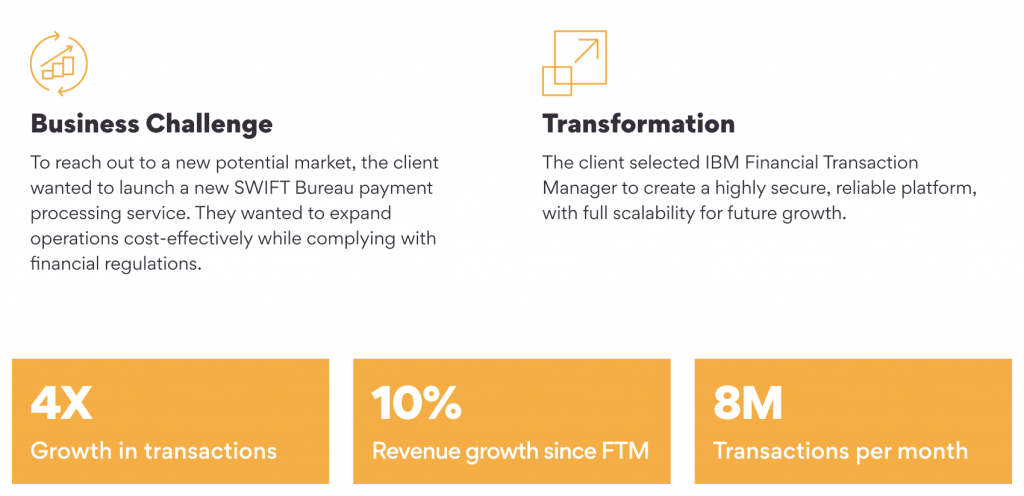

Business Use Case: A leading software and infrastructure provider for electronic payments increased revenue growth with a secure, scalable platform

Conclusion

In today’s highly competitive business environment, companies are under constant pressure to create new revenue streams. However, the lack of in-house expertise in emerging technologies can make it costly and time-consuming to sustain digital platforms. IBM FTM is a comprehensive payment solution that enables enterprises to modernize payments infrastructure, manage complex regulatory changes, enhance operational efficiency, and ensure GTM agility to meet customer demands.

If you are looking to modernize your payment infrastructure, click here to learn more about our offerings.

References:

- Boston Consulting Group: Payments Revenues Will Stay Resilient Despite Headwinds

- Fraud Detection and Prevention Market Size [2022-2029] Exhibits 22.8% CAGR to Reach USD 129.17 Billion in 2029

- Payment as a Service Market Size Worth $25.7 Billion by 2027: Grand View Research, Inc.

- Maveric Message Translation solution – ISO 20022 compliance made simple