Policy on Related Party Transactions (RPT)

January 2025

Revision History

| Date | Version | Description | Author | Reviewed by | Adopted by | Status | Effective Date |

|---|---|---|---|---|---|---|---|

| October 17, 2014 | 1.0 | Related Party Transactions Policy and Procedures | Rohit Kamat | Board of Directors | Board of Directors | Approved | October 17, 2014 |

| March 30, 2022 | 2.0 | Related Party Transactions Policy and Procedures | Sunil Sapre | Sunil Sapre | Audit Committee | Approved | April 1, 2022 |

| January 21, 2025 | 3.0 | Related Party Transactions Policy and Procedures | Vinit Teredesai | Vinit Teredesai | Audit Committee | Approved | January 21, 2025 |

A. Applicability

This policy is formed as a part of Corporate Governance Framework as per requirement of Regulation 23 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (the ‘ SEBI (LODR) Regulations, 2015’) as amended from time to time and also in terms of Section 188 of the Companies Act, 2013 and the rules made thereunder.

B. Purpose

- To regulate transactions between the Company, its subsidiaries and its Related Parties with a view to ensure that such transactions are executed on an arm’s length basis and in a transparent and fair manner.

- To seek necessary approvals of the AC/Board/shareholders as may be necessary, after providing necessary information to them in the prescribed manner.

- To outline the procedures for identification, review, approval, disclosure and reporting of such transactions.

This Policy shall supplement the Company’s other policies in force that may be applicable to or involve transactions with Related Parties.

C. Definition

- “Associate Company”, in relation to another company, means a company in which that other company has control of at least twenty percent of Authorized Share Capital, or of business decisions under an agreement, but which is not a subsidiary company of the company having such influence and includes a joint venture company.

- “Audit Committee” or “AC” means Committee of Board of Directors of the Company constituted under provisions of Listing Agreement and the Companies Act, 2013.

- The term “Control” shall have the same meaning as defined in SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.

- “Key Managerial Personnel” means key managerial personnel as defined under the Companies Act, 2013 and includes-

- Managing Director, or Chief Executive Officer or manager and in their absence, a

Whole time director - Company Secretory

- Chief Financial Officer

- Managing Director, or Chief Executive Officer or manager and in their absence, a

- “Material Related Party Transaction” means a transaction with a related party if the transaction / transactions to be entered into individually or taken together with previous transactions during a financial year, exceed rupees one thousand crore or ten per cent of the annual consolidated turnover of the Company as per the last audited financial statements of the Company, whichever is lower.

- “Material Modifications” means any modification to an existing related party transaction, approved by the Audit Committee/ Board of Directors / Shareholders, as the case may be, which will change the complete nature of the transaction and in case of monetary thresholds which is in excess of 10% of the originally approved transaction amount

- “Office or place of profit” means any office or place –

- where such office or place is held by a director, if the director holding it receives from the Company anything by way of remuneration over and above the remuneration to which he is entitled as director, by way of salary, fee, commission, perquisites, any rent‐free accommodation, or otherwise

- where such office or place is held by an individual other than a director or by any firm, private Company or other body corporate, if the individual, firm, private Company or body corporate holding it receives from the Company anything by way of remuneration, salary, fee, commission, perquisites, any rent‐free accommodation, or otherwise

- “Policy” means Related Party Transaction Policy.

- “Relative” means relative as defined under Section 2(77) of the Companies Act, 2013

- “Related party” means related party as defined in Regulation 23 of SEBI (LODR) Regulations, 2015 which is as follows:

-

- a related party as defined under sub-section (76) of Section 2 of the Companies Act, 2013 or under the applicable accounting standards

- any person or entity forming a part of the promoter or promoter group.

- any person or any entity, holding equity shares:

a. of twenty percent of more; or

b. of ten per cent or more, with effect from April 1, 2023 in the Company either directly or on a beneficial interest basis as provided under section 89 of the Companies Act, 2013, at any time, during the immediately preceding financial year.

- “Related Party Transaction” means a transaction involving a transfer of resources, services or obligations between:

I. The Company or any of its subsidiaries on one hand and a related party of the Company or any of its subsidiaries on the other hand; or

II. The Company or any of its subsidiaries on one hand, and any other person or entity on the other hand, the purpose and effect of which is to benefit a related party of the Company or any of its subsidiaries, with effect from April 1, 2023;regardless of whether a price is charged and a “transaction” with a related party shall be construed to include a single transaction or a group of transactions in a contract which fall under one or more of the categories as specified under Section 188 of the Companies Act, 2013 i.e.: transfer of resources, services or obligations between a company and a related party, regardless of whether a price is charged and also includes the transactions/ contracts/ arrangement between the Company and its related parties which fall under one or more of the following headings

- Sale, purchase or supply of any goods or materials;

- Selling or otherwise disposing of, or buying, property of any kind;

- Leasing of property of any kind;

- Transfer of research and development

- License agreements

- Finance (including loans and equity contributions in cash or kin

- Guarantees and collaterals

- (viii) Management contracts including for deputation of employees Provided that the following shall not be a related party transaction:

a. the issue of specified securities on a preferential basis, subject to compliance of the requirements under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018;

b. the following corporate actions by the listed entity which are uniformly applicable/offered to all shareholders in proportion to their shareholding:

i. payment of dividend.

ii. subdivision or consolidation of securities.

iii. issuance of securities by way of a rights issue or a bonus issue; and

iv. buy-back of securities. - “Transaction on arm’s length basis” means a transaction between two related parties that is conducted as if they were unrelated, so that there is no conflict of interest.

- “Transactions in the Ordinary Course of Business” means activities that are necessary, normal, and incidental to the business and which fall under one or more of the following headings:

- Import / export of services

- Import of Fixed assets / spares / computers

- Purchase and Sale of Fixed assets

- Royalty Received / paid

- Commission Income received / paid

- Re-imbursement of expenses

- Dividend Received / paid

- Loans and Advances paid and repaid

- Interest received on Loans given

- Interest paid on Loans received

- Any other as the AC may deem fit.

D. Policy

I. Approval of Related Party Transactions by the AC

- All Related Party Transactions and subsequent material modifications shall require prior approval the AC and referred for approval in accordance with this Policy.

- Related party transaction to which the subsidiary of the Company is a party, but the Company is not a party, shall require prior approval of the AC if the value of such transaction whether entered into individually or taken together with previous transactions during a financial year exceeds ten per cent of the annual consolidated turnover, as per the last audited financial statements of the Company.

- With effect from April 1, 2023, a related party transaction to which the subsidiary of the Company is a party, but the Company is not a party, shall require prior approval of the AC if the value of such transaction whether entered into individually or taken together with previous transactions during a financial year, exceeds ten per cent of the annual standalone turnover, as per the last audited financial statements of the subsidiary.

- The AC approval is not required for the transactions with the wholly owned subsidiaries of the Company and transactions entered into between two wholly owned subsidiaries of the Company, whose accounts are consolidated with the Company and placed before the shareholders at the general meeting for approval.

- Any member of the AC who has a potential interest in any Related Party Transaction will refrain himself/herself from discussion and voting on the approval of the Related Party Transaction.

- The AC may have an umbrella resolution under which Related Party Transaction with a value of upto INR 1 Crore can be entered into without the AC approving it in its meeting

- The AC may grant Omnibus approval for proposed Related Party Transactions which are repetitive in nature.

- The AC shall review at least on quarterly basis, the details of RPTs entered into by the Company pursuant to each of the omnibus approval given.

- Such omnibus approval shall be valid for a period not exceeding one year and shall require fresh approvals after the expiry of one year validity.

- Only the independent directors who are the members of the AC shall approve the related party transactions.

- 11. The members of the Audit Committee may ratify related party transactions within 3 (three) months from the date of transactions or in the immediate next audit committee meeting, whichever is earlier subject to the conditions as mentioned under regulation 23(2)(f) of the SEBI (LODR) Regulations, 2015, as amended from time to time. In case, the ratification of the transaction fails, the Audit Committee may consider the transaction to be voidable. In case any Director has authorized a transaction with another Director, then the concerned Directors will have to indemnify the listed entity in case any loss is incurred.

II. Approval of Related Party Transactions by the Board and Shareholders:

- In the event contract /arrangement / transaction is not in the ordinary course of business or at arm’s length, the Company shall comply with the provisions of the Companies Act 2013 and the Rules framed thereunder and obtain prior approval of the Board and its shareholders, as applicable, for such contract / arrangement / transaction.

- In case of transaction, other than transactions referred to in Section 188 of the Companies Act, 2013, and where Audit Committee does not approve the transaction, it shall make its recommendations to the Board of Directors of the Company for approval of such transactions

- Where Related Party Transactions require approval of the Board through special resolution; any director who is interested in any contract / arrangement / transaction with a related party, shall not be present at the meeting during discussions on the subject-matter of the resolution relating to such contract / arrangement / transaction.

- All material related party transactions and subsequent material modifications thereto as defined by the AC shall require prior approval of the shareholders through special resolution and no related party shall vote to approve such resolutions whether the entity is a related party to the particular transaction or not.

E. Pre-approved Transactions:

Following transactions shall not require approval of the Board; and shall be considered as

pre-approved:

- Compensation (including the reimbursement of reasonable business and travel expenses incurred in the ordinary course of business) payable to Executive Directors or Key Management Personnel which is approved by Compensation and Remuneration Committee of the Board

- Transactions in the ordinary course of business, arm’s length basis and with wholly owned subsidiaries and transactions entered into between two wholly owned subsidiaries, whose accounts are consolidated with the Company and placed before the shareholders at the general meeting for approval

- Contributions by the Company or any of its affiliates to a charitable organisation, foundation at which Related Party is a Trustee or director; provided that the total contribution does not exceed limit as prescribed under Section 135 of the Companies Act, 2013

- Any transaction in which the Related Party’s interest arises solely from ownership of securities issued by the Company and all holders of such securities receive the same benefits pro-rata as the Related Party.

- Allotment of ESOPs/RSUs to Key Managerial Personnel under the schemes already approved by shareholders

- Transaction(s) undertaken by the Independent Director with the Company or its holding, subsidiary, or associate company or their promoters or directors during the year and during two immediately preceding financial years shall not fall in the ambit of pecuniary relationship with the Company:

a. Transaction(s) done in ordinary course of business at arm’s length;

b. Receipt of remuneration by way of sitting fees and commission;

c. Re‐imbursement of expenses for attending board and other meetings.

F. Procedure for Identification and maintaining record of potential Related Party Transactions:

- The Secretarial department shall at all times maintain a database of Company’s Related Parties containing the names of individuals and Companies, identified on the basis of the definition set forth in Definition Clause 9 above, along with their personal/company details including any revisions therein.

- The Related Party List shall be updated whenever necessary and shall be reviewed at least once a year, as on 1st April every year.

- The Secretarial department shall collate the information, coordinate and send the list of Related Parties to Chief Financial Officer (CFO) or any officer designated by CFO (Responsible person).

- This analysis and identification of the proposed transactions or contracts with the parties in the list above can be done by the Responsible Person independently or in consultation with outside consultant, as appropriate.

- When the Responsible Person after due analysis, identifies the proposed transaction or relationship, with the parties in the above list as Related Party Transaction requiring compliance with the Policy, he / she will refer the provided with all relevant material information of proposed Related Party Transactions; including the terms of the transaction, the business purpose of the transaction, the benefits to the Company and to the Related Party, and any other relevant matters to the AC in their next scheduled meeting for review and approval and convey back the decision to the originator of the transaction.

- Each Director and Key Managerial Personnel shall make an annual declaration / disclosure (Ref Annex. I ) to the Secretarial department of the Company on the last day of the month ending before the financial year and this Declaration / Disclosure shall be placed before the AC and the Board at their first meeting held at the succeeding financial year. Any change in the list of relatives shall be intimated by the Directors and Key Managerial Personnel by way of a fresh declaration to the Company within 7 days of such change.

- Every new appointed director or key managerial personnel shall, within a period of thirty days of his/her appointment, or relinquishment of his office in other Companies, as the case may be, disclose to the Company the particulars relating to his/her concern or interest in the other associations.

- The Secretarial department shall keep and maintain a register, physically or electronically, as may be decided by the Board, giving separately the particulars of all transactions or contracts or arrangements to which this policy applies. The register shall be preserved permanently and shall be kept in the custody of the Company Secretary of the Company or any other person authorized by the Board for the purpose.

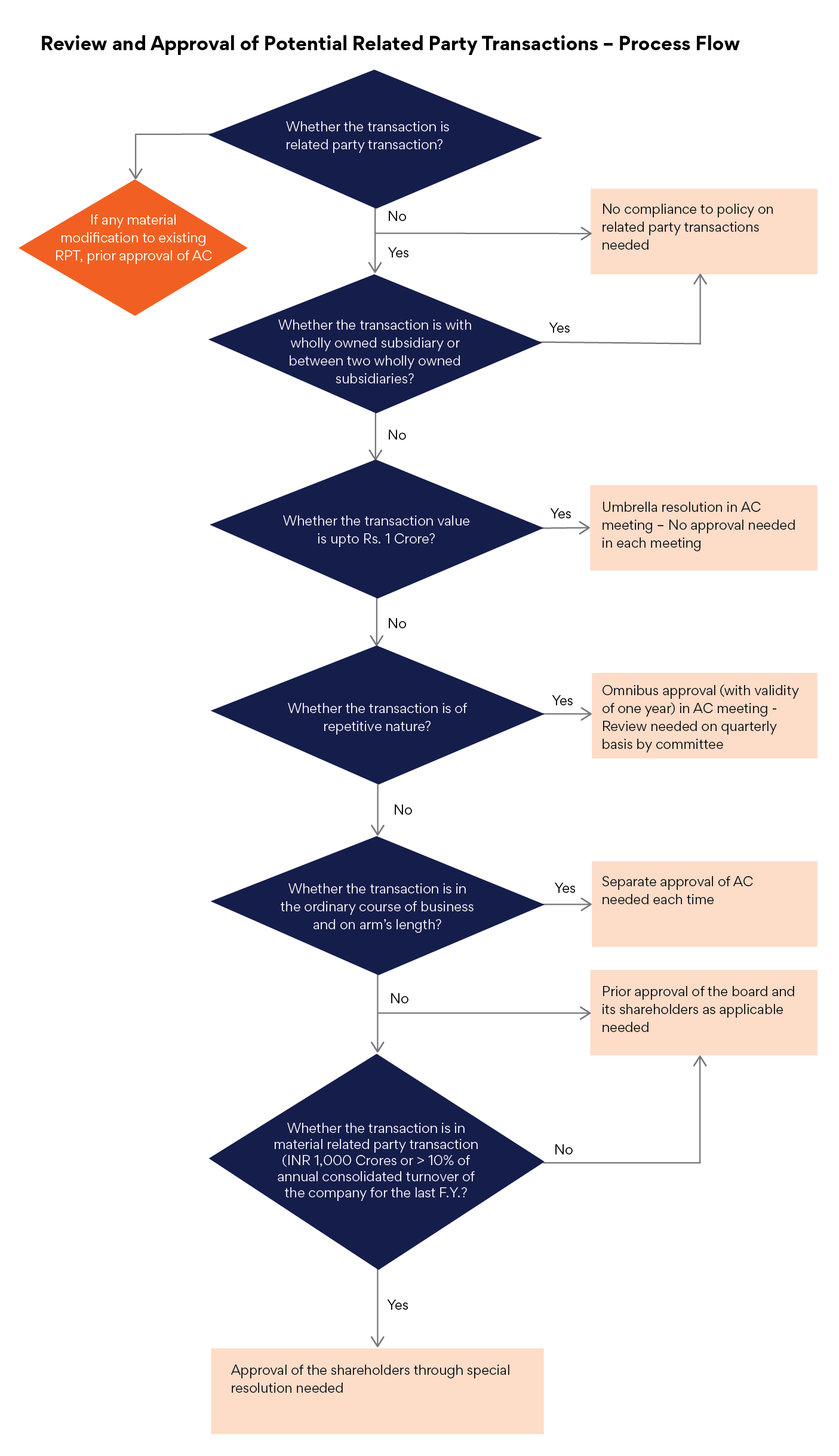

G. Procedure for Review and Approval of potential Related Party Transactions:

Ref Annex. II

H. First time adoption of the Policy

All the Related Party Transactions known up to the Responsible Person on the date of approval of the Policy, will be presented before the AC in its meeting held for adoption of this policy. The AC shall review and approve the transactions as per guidelines prescribed under this Policy.

I. Periodical Review / Amendments of the Policy

The AC shall periodically review this Policy and may recommend amendments to this Policy from time to time as it deems appropriate.

J. Amendment:

In case there are any amendments are to be made to this Policy, the Audit Committee should approve those amendments and recommend the same to the Board of Directors for its consideration and approval before making the said amendment effective.

Further, any subsequent amendment / modification in the Listing Regulations or the Act or any other governing Act/Rules/Regulations or re-enactment, impacting the provisions of this Policy, shall automatically apply to this Policy and the relevant provision(s) of this Policy shall be deemed to be modified and/or amended to that extent, even if not incorporated in this Policy.

K. Disclosures:

- Details of all material transactions with related parties are to be disclosed quarterly along with the compliance report on corporate governance.

- All Related Party Transactions shall be disclosed in the Company’s quarterly audited financial statements and Annual Report and applicable statutory filings.

- The Related Party Transactions shall be submitted to the stock exchanges on half-yearly basis in accordance with the prevailing Regulation followed by its publication on the website of the Company, in the format as specified by the governing authorities from time to time as on the date of publication of its Standalone and Consolidated Financials Results.

- The contract or arrangements entered into with the Related Parties shall be disclosed in the Board Report to the shareholders along with the justification for entering into such contract or arrangement.

- This Policy shall be disclosed on the Company website and a web link thereto shall be provided in the Annual Report.

ANNEXURE I

To,

The Company Secretary / Chief Financial Officer

Persistent Systems Limited,

Bhageerath,

402 Senapati Bapat Road,

Pune 411 016, India

Dear Sir,

I, ____________________________________, being a Member of the Board of Directors / Key Managerial Personnel of Persistent Systems Limited hereby acknowledge, confirm and certify that:

- I am aware of the Policy on Related Party Transactions of the Company.

- During the financial year _______________, I have entered into the following contracts / arrangements / transactions with the Company and such contracts / arrangements / transactions qualify as “Related Party Transactions” as per the Policy.

- I am not aware of any non‐compliance with the said policy.

Signature:

Name:

Designation:

Date:

Place:

ANNEXURE II

Contact us

(*) Asterisk denotes mandatory fields